Traders work on the floor of the New York Stock Exchange on Jan. 29, 2024.

The S&P 500 and Nasdaq Composite closed at fresh records as Nvidia lifted tech stocks and investors looked ahead to the Federal Reserve's interest rate decision.

The broader market index advanced by 0.26%, closing at 5,360.79, while the Nasdaq Composite gained 0.35% to end at 17,192.53. The Dow Jones Industrial Average added 69.05 points, or 0.18%, ending at 38,868.04.

Nvidia shares added roughly 0.8% as the stock's 10-for-1 spilt took effect. Meta Platforms jumped nearly 2%, pushing the S&P 500 tech sector about 0.3% higher.

The Fed's latest rate decision and May's consumer price index slated for Wednesday could be key tests for markets, especially after Friday's strong jobs report continued to suggest the central bank could hold off on lowering rates.

Get top local stories in San Diego delivered to you every morning. Sign up for NBC San Diego's News Headlines newsletter.

Investors will parse through the Fed's updated projections on the timing and frequency of rate cuts. Markets are now pricing in just one rate cut this year, coming in November, according to the CME FedWatch Tool.

But Sam Stovall, chief investment strategist at CFRA, said inflation is still lingering at elevated levels, causing lasting concerns among investors.

"For me, the big worry is that the Fed has not gone far enough for long enough," he told CNBC in a recent interview. "I think that at least is going to keep us sort of range bound, and probably stop the markets going much further in the near term."

Money Report

In fact, in the next few weeks, Stovall sees the market pulling back at least 5% in a mild correction.

S&P 500, Nasdaq cinch new record closes

The S&P 500 and Nasdaq Composite both closed at new record highs on Monday.

The 500-stock index rose 0.26% to close at 5,360.79, while the tech-heavy Nasdaq added 0.35% and settled at 17,192.53. The Dow Jones Industrial Average rose 0.18% and finished at 38,868.04.

— Lisa Kailai Han

The equity market is getting more narrow, Raymond James says

Investors largely predicted that the market rally would broaden in 2024, with small-cap stocks stealing more of the spotlight away from their larger counterparts.

However, midway through the year, it seems that the already-narrow market just keeps getting more and more constrained, according to Raymond James.

"The market just keeps getting narrower, as the S&P 500 finished the week was up +1.3%, essentially at all-time highs, while small and mid cap indexes were down ~2%, below 50-DMA and down well below all-time highs," the financial institution wrote.

— Lisa Kailai Han

Eli Lilly shares hit fresh highs after FDA panel says its Alzheimer's drug is effective

Eli Lilly shares have already gained about 48% year to date, but the stock hit a fresh 52-week high in trading Monday. A U.S. Food and Drug Administration panel unanimously agreed its Alzheimer's treatment, donanemab, was effective for patients in the early stages of Alzheimer's disease. Although the panel's recommendations are nonbinding, the agency typically follows its guidance.

Similar to Leqembi, a competing therapy developed by Eisai and Biogen, Eli Lilly's drug works to remove the buildup of beta-amyloid plaques in the brains of patients who have the fatal disease.

— Christina Cheddar Berk

Rate hikes are unlikely despite strong May jobs report, UBS says

May's jobs report came in stronger than expected, but is still not enough to warrant any rate hikes in the near future, according to UBS.

The strong jobs report, combined with other indicators signifying the economy is slowing down, paints a mixed picture and complicates the Federal Reserve's job this year. But UBS is still pricing in two rate cuts this year, starting in September.

"Overall, we keep our view that the U.S. economy is slowing," the bank added.

To that end, UBS recommended investors stick to quality bonds as well as technology stocks such as semiconductor names.

— Lisa Kailai Han

California pension fund comes out against Elon Musk pay package at Tesla

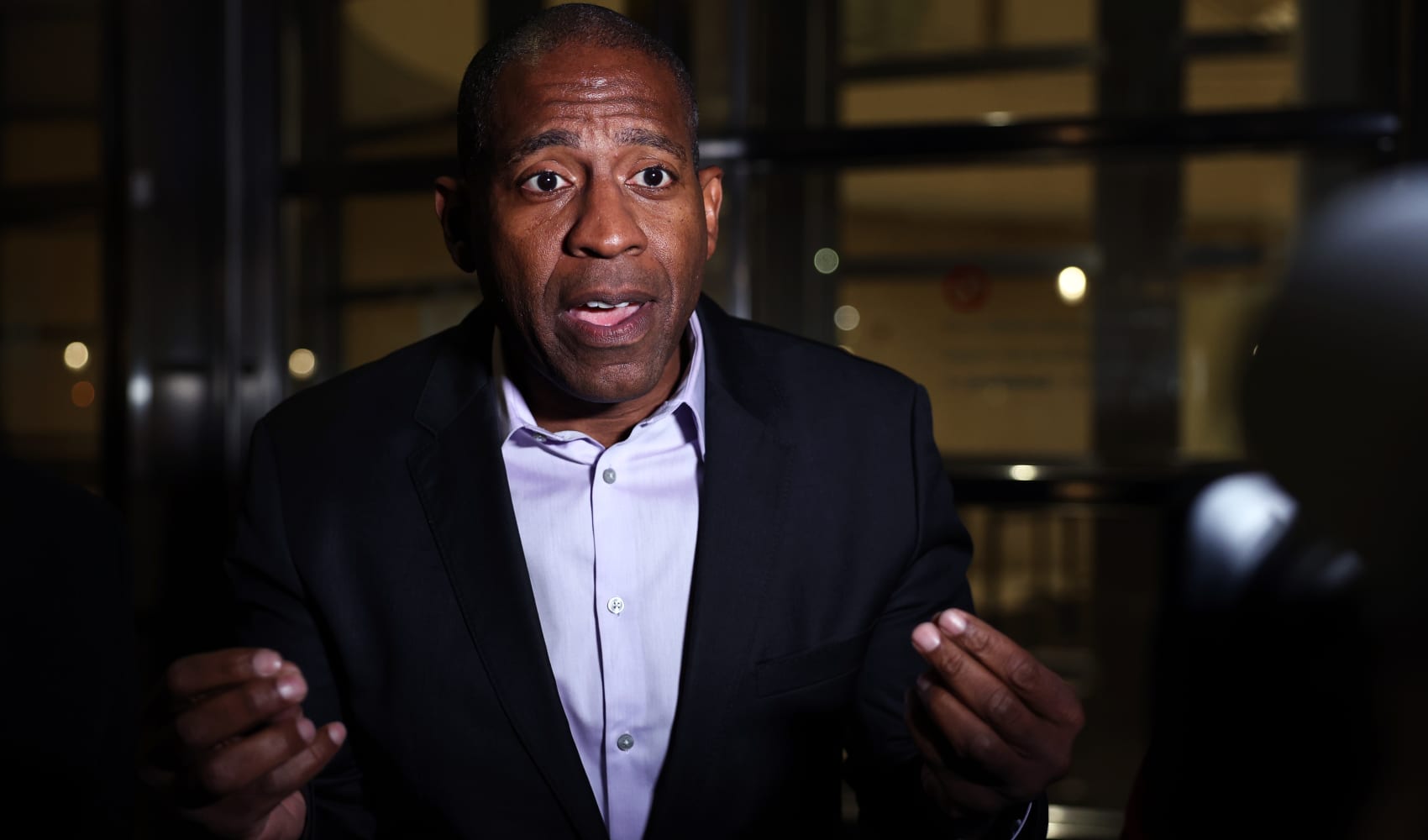

CalSTRS Chief Investment Officer Chris Ailman told CNBC on Monday that he will be voting against Elon Musk's Tesla pay package this week.

"We'll pay him 140-times the average worker pay. How about that deal? I think that's more than fair. This pay package is ridiculous," Ailman said on "Squawk on the Street."

CalSTRS is not the only major shareholder that has expressed concern over the package. The Norwegian sovereign wealth fund has also said it will vote against the proposal. Investment firm Bernstein warned that the package could fail to pass and potentially spark a sell-off in the stock.

Shares of Tesla were down about 1% in afternoon trading.

— Jesse Pound

Apple drops 2% as iPhone maker announces AI plans

Shares of Apple hovered near session lows, falling 2% as the company outlined its artificial intelligence plans, dubbed Apple Intelligence.

Some AI enhancements include systemwide proofreading for third-party and native apps, and generative AI photo capabilities using a user's photo library.

The AI updates also include a makeover for Siri, allowing the tool to take action across applications.

— Samantha Subin, Rohan Goswami and Kif Leswing

Apple's record on WWDC keynote days is not good

Apple stock has a history of struggling on days when CEO Tim Cook delivers a keynote speech at the company's Worldwide Developers Conference. In fact, shares have fallen in eight of the past 10 keynote days:

- 2023: up 0.22%

- 2022: down 3.6%

- 2021: up 0.98%

- 2020: down 3.07%

- 2019: down 1%

- 2018: down 0.9%

- 2017: down 3.9%

- 2016: down 2.3%

- 2015: down 1.1%

- 2014: down 0.27%

— Fred Imbert

Apple shares slip nearly 2% during WWDC event

Apple shares were last down 1.7% and hovered near session lows as the company announced a new round of software updates at its Worldwide Developers Conference.

Among the announcements, Apple revealed iOS 18 and the newest iteration of OS for its Vision Pro headset. The company also announced some improvements to AirPods, including head motion detection via Siri.

Apple is expected to share plans related to its artificial intelligence vision during the event.

— Samantha Subin

11 stocks in the S&P 500 hit new 52-week highs

Eleven stocks in the S&P 500 hit new 52-week highs during Monday's trading session.

Of these names, six stocks hit new all-time highs. These included:

- HCA trading at all-time-high levels back to its initial public offering in March 2011

- Eli Lilly trading at all-time-high levels back to 1952 when the company offered its first public shares of stock

- Verisk Analytics trading at all-time highs back to its IPO in September 2009

- Applied Materials trading at all-time-high levels back to its IPO in October 1972

- Micron trading at all-time highs back to its IPO in June 1984

- Iron Mountain trading at all-time-high levels back to its IPO in July 1997

On the other hand, S&P 500 stocks that hit new 52-week lows included Brown-Forman, Molson Coors, Robert Half and Cisco.

— Lisa Kailai Han, Christopher Hayes

These are the stocks making the biggest moves midday

Here are some of the stocks on the move during midday trading:

- Southwest Airlines — The stock rose 9% after activist hedge fund Elliott Management amassed a $1.9 billion stake in Southwest Airlines.

- GameStop — The meme stock slipped nearly 15% in volatile trading after a roller-coaster week. GameStop added to Friday's steep losses after investors responded to the company's earlier announcement that sales dropped significantly in the first quarter and that it was selling more stock.

- Advanced Micro Devices — The chipmaker fell 3% after Morgan Stanley downgraded shares to equal weight from overweight, saying investors' expectations look elevated.

Read the full list of stocks on the move here.

— Samantha Subin

Edgar Bronfman and Bain Capital team up in play for Paramount, WSJ says

Edgar Bronfman Jr. and private-equity firm Bain Capital have teamed up in a surprise bid for the company that controls Paramount Global, The Wall Street Journal reported midday Monday.

Bronfman Jr., best known for formerly running Warner Music and vodka maker Seagram, backed by Bain Capital, wants to offer as much as $2.5 billion for Shari Redstone's privately held National Amusements, a movie theater company that controls Paramount, the Journal said, citing unnamed people familiar with the matter.

Redstone is in advanced talks to sell a majority stake in National Amusements to Skydance Media. Separately, the Journal has also reported that Hollywood producer Steven Paul is busily lining up Wall Street financing to offer as much as $3 billion for National Amusements.

— Scott Schnipper

France ETF tracks for worst session in almost one year

The iShares MSCI France ETF (EWQ) headed for its worst day in nearly a year.

Shares slipped around 2.4% in morning trading. If that holds through session close, it will mark the fund's biggest one-day loss since July 6, 2023, when the exchange-traded fund slipped about 2.5%.

Soc Gen, Aeroports de Paris, Eiffage and BNP Paribas led the fund down. Each dropped more than 5%.

The ETF has risen more than 3% on the year.

— Alex Harring, Gina Francolla

What to expect from Apple's event

The pressure is heating up on Apple to show off its artificial intelligence capabilities potential at its Worldwide Developers Conference on Monday.

Read what Wall Street expects the iPhone maker to announce and what it means for the stock here.

— Samantha Subin

Inflation outlook still higher than the Fed's target, survey shows

Consumer expectations for inflation were little changed in May though they remain well above the level where policymakers feel comfortable, according to a New York Federal Reserve survey released Monday.

The central bank district's Survey of Consumer Expectations showed the one-year outlook for inflation edging lower to 3.2%, down 0.1 percentage point from April. At the three-year horizon, it was unchanged at 2.8%, while the five-year outlook moved up to 3%, a 0.2 percentage point rise.

All are higher than the Fed's 2% goal heading into the central bank's policy meeting that concludes Wednesday.

— Jeff Cox

GameStop shares in the red, Wedbush says 'Roaring Kitty' boost is fading

GameStop shares slipped 1% in volatile trading Monday even after the meme stock had jumped in premarket trading.

The video game company said it was selling an additional 75 million shares but Wedbush is skeptical that new cash raised from the stock sale could result in any meaningful step in its effort to turn around its struggling business.

"We cannot see how GameStop adds any value by operating any new businesses, particularly not now after its entire C-suite was either terminated or chose to depart," Wedbush analyst Michael Pachter said in a note.

Pachter noted that GameStop's prior strategy to be like Amazon was "an abject failure" as three former Amazon executives it hired to pursue the strategy left the company. Then, its plan to sell NFTs fell apart after it partnered with the now defunct FTX, he added.

The analyst believes that the boost GameStop got from meme stock leader Keith Gill could turn out to be short-lived.

"We suspect that today's live stream from influencer Keith Gill (Roaring Kitty) will keep shares elevated long enough to the company to complete its ATM, but with no clear strategy, we suspect the share price will once again begin to descend and approach our new price target," Pachter said.

— Yun Li

Nvidia could one day be 15% of S&P, Evercore ISI says

Nvidia may be on a path to dominating the S&P 500 at some point, according to Evercore ISI.

In a Friday note, chip analyst Mark Lipacis said the stock could become 10% to 15% of the index one day. This volume would give it more than double the influence of current leader Microsoft and other past leaders Apple and Nokia. CNBC Pro subscribers can read more here.

Shares of Nvidia were flat during its first day of trading following its 10-for-1 stock split.

— John Melloy, Sean Conlon

Natural gas prices hit highest level since January on summer heat wave

Natural gas prices have broken above $3 per thousand cubic feet to trade at the highest level since January.

Lower gas production in June combined with a summer heat wave "have conspired to chip away" at the huge storage surplus, according to Bob Yawger, executive director of energy futures at Mizuho Securities.

Natural gas prices have rebounded from a dramatic pullback earlier in the year and are now up 22% in 2024 and 36% year over year.

However, Yawger cautioned that natural gas is in overbought territory. "Beware of a pullback in coming days," he said.

— Spencer Kimball

Stocks open lower

All three major stock indexes opened in the negative Monday morning.

The broader S&P 500 index slipped 0.2%. The Dow Jones Industrial Average lost 13 points, while the Nasdaq Composite fell 0.3%.

— Lisa Kailai Han

Stocks making the biggest moves premarket

Check out the companies making headlines in premarket trading:

- KKR, CrowdStrike, GoDaddy — Shares of KKR climbed more than 8%, while CrowdStrike and GoDaddy added 6% and 3%, respectively. All three companies will join the S&P 500 on June 24, as part of the index's quarterly rebalance. The three stocks leaving the index are Robert Half, Comerica and Illumina, S&P Dow Jones Indices announced Friday. Those stocks were all lower in premarket trading. Shares of Dell Technologies and Palantir Technologies fell 1% and 3%, respectively, amid disappointment that the two stocks were not added to the index.

- AMD — Stock in the chipmaker slipped more than 2% following a downgrade from Morgan Stanley, with analyst Joseph Moore saying Wall Street's expectations for artificial intelligence benefits may be out of reach.

- DraftKings — The sports betting stock added 1.8% after Morgan Stanley reiterated its overweight rating and said shares were once again worthy of a top pick designation. Morgan Stanley said the stock can rally despite concerns around Illinois' legalization of a sports betting tax.

Read the full list here.

— Brian Evans

A strong May jobs report means good things for equities, Bank of America says

May's jobs report came in stronger than expected, reducing concerns among investors that the U.S. economy is beginning to slow down.

According to Bank of America, strong macroeconomic fundamentals ultimately mean good things for stocks, even if inflation lingers at higher levels for longer.

"If macro starts to improve, equities should be able to withstand higher levels of inflation. If NFP was just a head-fake and macro slows, inflation would have to come down to support stocks, and it likely will," the bank wrote.

— Lisa Kailai Han

GameStop jumps nearly 8% after roller-coaster week

GameStop shares climbed nearly 8% in premarket trading Monday, set for a rebound from Friday's big sell-off.

The meme stock had a roller-coaster week, which surged first after Keith Gill, the trader who inspired 2021's epic mania, shared screenshots of his portfolio holding massive positions in the video game retailer.

GameStop tanked Friday, however, as investors responded to the company's earlier announcement that sales dropped significantly in the first quarter and that it was selling more stock.

Meanwhile, Gill, better known as "Roaring Kitty," on social media site X and YouTube hosted his first livestream in a few years Friday. He revealed that he didn't have any institutional backers and the GameStop positions he had shared in screenshots were his only bets. Gill also reiterated his previous investing thesis and offered little new reasoning behind his large stake.

The stock plunged nearly 40% Friday, but still posted a 22% gain last week.

— Yun Li

JPMorgan upgrades Walmart

JPMorgan upgraded Walmart to overweight and said the shares can rally 23% over the next year and a half to $81, saying it was time to get defensive amid a softening consumer environment.

The firm also gave a macroeconomic reason behind the call.

The upgrade was partly due to "our desire to add more defensiveness to our ratings given signs of softening discretionary spending while we also we stare down a very uncertain backhalf that includes the presidential election cycle, holiday calendar blues with five fewer days/Christmas on a Wednesday, and an unclear outlook on rate cuts," stated JPMorgan.

Walmart shares were 1% higher in premarket trading.

CNBC Pro subscribers can read more about the call here.

— John Melloy

Nvidia shares slide to start the week

Nvidia slipped 0.4% Monday, the first day for the stock reflecting a 10-for-1 split. Shares have been on fire this year, surging more than 144%.

— Fred Imbert

European stocks under pressure

European stocks were under pressure Monday as concerns grew over right-leaning politicians gaining traction in the region.

The Stoxx 600 index, which includes a broad swath of European stocks, fell 0.8%. France's CAC 40 dropped 2.2% after French President Emmanuel Macron called snap parliamentary elections to be held later this month following a big loss in initial EU Parliament election results.

Germany's Dax index lost nearly 1%.

— Fred Imbert

May inflation data set to release this week

Investors are looking ahead to May's consumer price index that is set to release Wednesday.

Economists polled by Dow Jones anticipate a rise of 3.4% from the year-ago period, and a 0.1% increase on a monthly basis. That is compared to increases of 3.4% and 0.3%, respectively, in the prior reading.

Core CPI, which excludes volatile food and energy prices, is expected to show an increase of 3.5% year over year, and a 0.3% gain on the month. Previously, it gained 3.6% and 0.3%, respectively.

— Sarah Min

Stock futures open flat

Stock futures opened little changed Sunday night.

Dow Jones Industrial Average futures rose 13 points. S&P 500 futures and Nasdaq 100 futures were flat.

— Sarah Min