The S&P 500 rose for a sixth straight day, overcoming a slump in Tesla as data indicated continued economic growth.

The broad index rose 0.53% to 4,894.16, clinching another all-time closing record. The Dow Jones Industrial Average added 242.74 points, or 0.64%, to 38,049.13. The Nasdaq Composite increased by just 0.18% to 15,510.50, weighed down by a post-earnings tumble in Tesla shares.

Despite Thursday's muted gains, the technology-heavy Nasdaq has outperformed this week, tracking to finish up 1.3%. The S&P 500 has advanced 1.1%, while the blue-chip Dow is 0.5% higher on the week.

Both the S&P 500 and Nasdaq have finished higher for the past six trading days. The benchmark S&P 500 has closed at a record high for five sessions in a row, the longest streak since November 2021.

Get top local stories in San Diego delivered to you every morning. Sign up for NBC San Diego's News Headlines newsletter.

Gross domestic product data showed the U.S. economy grew at a rate of 3.3% in the fourth quarter. That's much higher than the 2% expectation from economists polled by Dow Jones, underscoring continued economic resiliency despite interest rate hikes from the Federal Reserve.

Thursday's report also included encouraging data on the inflation front. The personal consumption expenditures price index posted a quarterly gain of 2% when excluding food and energy, a core gauge that the Fed prefers when assessing inflation. Headline inflation increased just 1.7%.

"That was a really healthy mix of data," said Kevin Gordon, senior investment strategist at Charles Schwab. "That's pretty much as close to nirvana as you can get for the Fed in looking for non-inflationary growth."

Money Report

But a sell-off in Tesla, a retail investor favorite, weighed on the market. Shares plunged more than 12% after the electric vehicle maker posted disappointing fourth-quarter results and warned of lower vehicle volume growth for 2024.

On the other hand, IBM jumped more than 9% after the technology company posted adjusted earnings and revenue that beat analysts' predictions.

More than one-fifth of S&P 500 companies have reported financials this earnings season, according to FactSet. Nearly 74% of those have surpassed Wall Street expectations, the firm's data shows.

Stocks finish higher

The three major indexes finished Thursday in the green.

The Dow climbed 0.6%. The S&P 500 rose 0.5% to a new all-time closing record. The Nasdaq Composite inched up about 0.2%, weighed down by a sell-off in Tesla.

Thursday's session marked the sixth straight winning session for both the S&P 500 and Nasdaq.

— Alex Harring

Lithium futures prices plummet more than 80% to lowest level ever

Lithium futures prices are plummeting as demand for electric vehicles slows in China.

The LME lithium futures contract has fallen more than 80% from its Dec. 1, 2022 high of $85,000 per metric ton to $14,627.73 as of Thursday.

This is the lowest price since the futures contract was created in July 2021.

— Spencer Kimball

S&P 500 Technology sector's weight reaches highest in index since 2000

The technology sector's weight in the S&P 500 topped 30% on Thursday, putting it at its highest weight in the index since 2000, according to data from Bespoke Investment Group.

The move in the sector comes as megacap technology stocks continue their march higher. Major chipmakers Nvidia and Advanced Micro Devices have notched new highs in recent sessions, while Microsoft punched above a $3 trillion market capitalization on Wednesday.

— Samantha Subin

Individual investors grow slightly less optimistic, and more neutral, on stocks in AAII poll

Individual investor optimism about the outlook for stock prices over the next six months dipped to 39.3% in the latest weekly survey by the American Association of Individual Investors, down from 40.4% last week and a 52-week high of 52.9% last Dec. 20. The historical average is 37.5%.

Neutral sentiment toward stocks climbed to 34.6% this week from 32.9% last week and just 27.2% the week before that. The historical average is 31.5%.

Bearish opinion about the short-term outlook for stocks also retreated this week, to 26.1% from 26.8% last week. Over the past year, investors were most bearish the week of Nov. 1, shortly after the October stock market bottom, when 50.3% said they were negative on stocks. The historical average for bearish views is 31.0%.

A special question to AAII members this week asked what they were watching most closely in fourth quarter earnings reports. A plurality of 38% answered "guidance on future revenues and earnings," topping "whether earnings were better or worse than expected" at 22% and "sales or earnings growth" with 20%.

— Scott Schnipper

Tesla in 2024 is approaching, and in some cases exceeding, solar stocks' losses

Tesla (-26.5%) has already lost more value in 2024 than Boeing (-23%), quite an impressive feat.

Now the EV maker is competing with washed out solar energy stocks to register some of the largest declines early in the new year.

For the time being, Sunnova Energy (-31.3% in 2024) and Sunrun (-27%) have declined more than Tesla so far this year. But Tesla now surpasses the declines in both SolarEdge Technologies (-25.3%) and Enphase Energy (-19.6%).

— Scott Schnipper

Where stocks stand entering final hour

The Dow and S&P 500 were on track for gains entering the final hour of trading, up about 0.3% each. The Nasdaq Composite lagged due to Tesla's selloff, trading around flat.

— Alex Harring

Tesla poised for worst day since 2020

Tesla plunged in the wake of the electric vehicle maker's latest earnings report, putting the stock on pace for its worst session in more than three years.

Shares were down about 12.5% shortly before 2:45 p.m. ET. If that holds through market close, it will mark its worst day since September 2020.

The drop came after Tesla missed expectations in the quarter and warned of a slowdown in 2024. Shares have slid more than 25% in the new year, giving up some gains after surging more than 100% in 2023.

— Alex Harring

GDP report suggests a ‘fairytale scenario’ may be in the cards for the U.S., Oanda's Erlam says

The fourth-quarter U.S. gross domestic product reading reflects an economy that's still faring well even amid high interest rates, according to Craig Erlam, senior market analyst at Oanda.

The U.S. economy grew at a 3.3% pace in the final quarter of 2023, surpassing the Street's expectations of a 2% increase – and reflecting a slowing from the third-quarter's GDP rate of 4.9%.

The results add "to the increasing view that the U.S> could be heading for a fairytale scenario, not just a soft landing," Erlam wrote in a report.

"We've spoken a lot about resilience in the US economy over the last couple years but that the economy can continue to show such strength and low unemployment with interest rates so high and inflation falling back toward target is unbelievable," he added.

-Darla Mercado

Stocks making the biggest midday moves

Here are some of the names moving in midday trading:

- Tesla – Shares tumbled more than 13%, a day after the EV maker posted weak auto revenue and warned of slower growth this year. Several firms have turned more cautious on the stock in the near term and cut their targets on Tesla.

- ResMed — Shares popped 7% after the medical device company reported an earnings and revenue beat for its fiscal second quarter.

- Northrop Grumman — Shares fell 5.5% after the defense contractor said it took a $1.17 billion charge related to the U.S. Air Force's next-generation B-21 bomber.

To see more midday movers, read the full story here.

— Michelle Fox

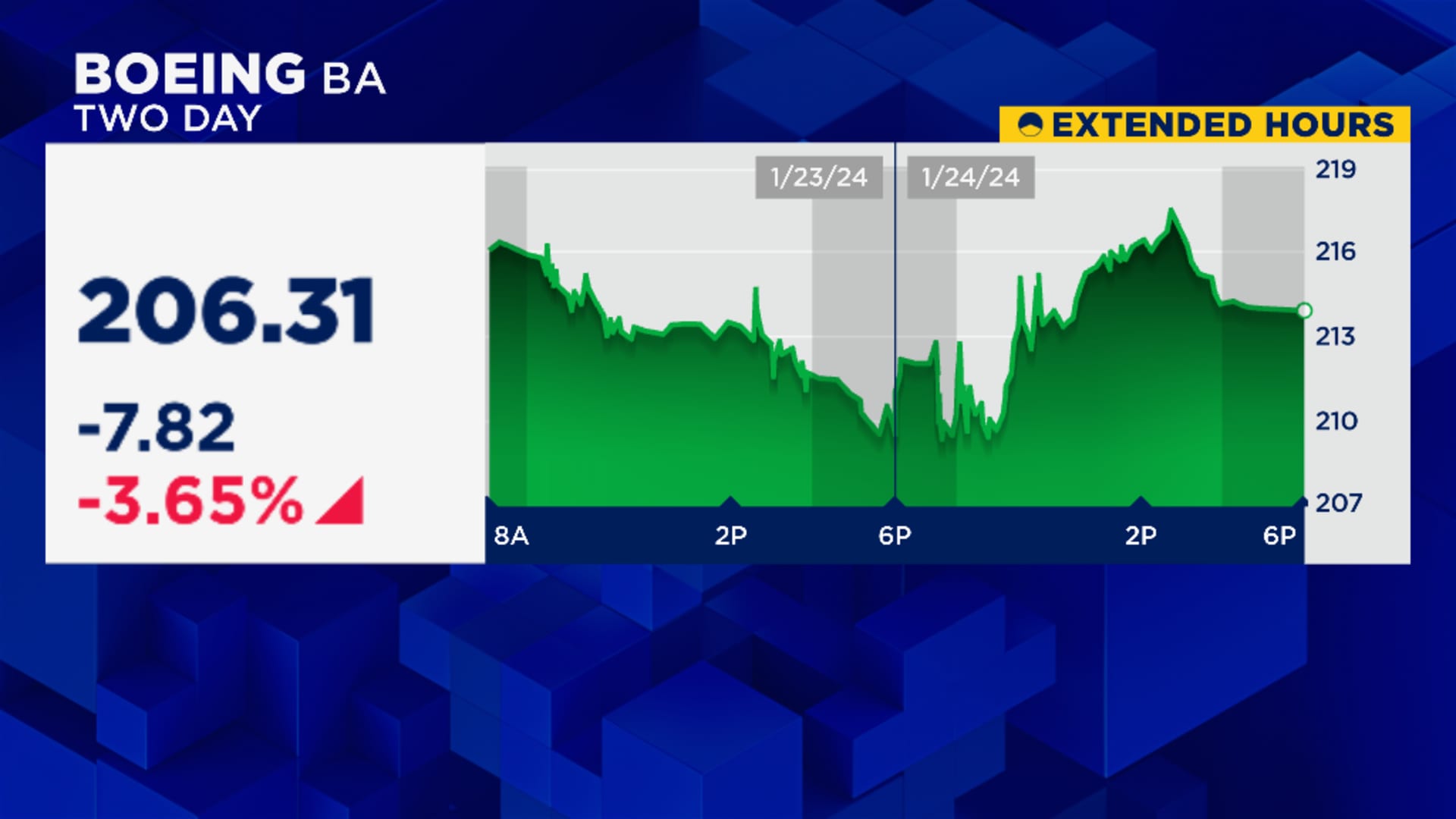

IBM outperforms in Dow, Boeing drags on the index

The Dow hovered near the flat line on Thursday. The 30-stock index was bolstered by gains in IBM, which jumped more than 10% after the tech company reported fourth-quarter results that topped analysts' expectations.

On the other hand, Boeing and UnitedHealth shares dragged on the index, last down by about 6%, each. Boeing, which is already lower by 22% this year, has been dealing with the fallout from the grounding of its 737 Max 9 airplanes after a door plug blew out during an Alaska Airlines flight earlier this month.

UnitedHealth is lower by more than 8% this year.

— Sarah Min

PayPal drops suddenly after announcing AI innovations

Shares of PayPal dropped as much as 6% Thursday afternoon after the company revealed artificial intelligence-powered innovations for merchants and consumers.

The company also announced enhancements to Venmo designed to encourage small business activity on the app.

PayPal shares were last lower by nearly 5%.

— Tanaya Macheel

Consumer discretionary and health care stocks buck S&P 500's ascent

Consumer discretionary and health care names capped gains for the S&P 500 on Thursday.

Both sectors slipped more than 1% in midday trading, making them the two worst performing of the 11 that comprise the S&P 500. Meanwhile, the broad index rose about 0.3% in the session.

Tesla dragged on the consumer discretionary sector, while Humana weighed down the health care group. Both stocks were sliding in post-earnings sell-offs.

On the other hand, the communication services, real estate and information technology sectors help push the S&P 500 higher. All three sectors climbed more than 1%.

— Alex Harring

U.S. crude breaks above $76 on strong economic growth, China stimulus

Oil prices rallied on Thursday as demand expectations rose on strong U.S. economic growth and China stimulus, while supply tightened after winter storms hit crude production.

The West Texas Intermediate contract for March rose $1.22, or 1.62%, to trade at $76.31 a barrel. The Brent March contract gained $1.21, or 1.51%, to trade at $81.25 a barrel.

U.S. crude remaining above $76 a barrel would indicate a breakout that confirms oil's immediate trend has moved to the upside, according to Matt Maley, chief market strategist with Miller Tabak.

This would be also a good sign for energy stocks which have lagged crude prices since mid-December, Maley said. If crude oil confirms a change in trend, energy stocks will have to play catch up, he told CNBC.

— Spencer Kimball

Electric vehicle stocks fall after disappointing Tesla results

Several popular electric vehicle stocks fell after Tesla posted disappointing quarterly results and warned of slowing growth after the bell Wednesday. The stock sank nearly 11% in morning trading.

Some industry laggards during Thursday's session included Rivian Automotive and Lucid Group, last down about 5% and 9%, respectively. Nio and Li Auto declined 3.5% and 1.4%, respectively.

The results from Tesla also pressured some semiconductor stocks linked to the automotive sector. On Semiconductor slumped 2.3%, while Wolfspeed declined 4.6%.

— Samantha Subin

Small-cap stocks outperform

Smaller stocks saw outsized gains on Thursday, bucking the trend seen so far in the new year.

The small-cap focused Russell 2000 advanced 0.7% in late morning trading. Meanwhile, the broad S&P 500 added just 0.4%,

That marks a reprieve from the story seen in 2024 so far. While the S&P 500 has climbed more than 2% since the trading year began, the Russell 2000 has dropped more than 2%.

— Alex Harring

Deutsche Bank cuts Humana to hold as company slashes forecast and warns of skyrocketing medical costs

Humana sounded a warning last week ahead of the release its fourth-quarter results, saying medical costs are soaring, but even the most pessimistic view failed to capture just how bad things were, Deutsche Bank analyst George Hill said, in a note downgrading the stock to hold from buy.

After seeing Humana's results, the analyst is calling 2024 a "lost year." He slashed his price target by 40% to $360. Humana shares are down 10% in trading Thursday, bringing its losses this month to 22%.

The bigger question, according to Hill, is whether this issue is isolated to Humana or if it will hurt other providers of Medicare Advantage. Investors seem to think it's a bigger problem, with shares of UnitedHealth, CVS Health and Centene all falling in sympathy.

—Christina Cheddar Berk

GDP data is what Fed wants to see, Harris Financial managing partner says

Thursday's gross domestic product data bodes well for those hoping to see the Federal Reserve cut interest rates in 2024, according to Jamie Cox, managing partner for Harris Financial.

"The headline data are the perfect mix of strong consumption and dropping inflation," Cox said. "This is exactly what you want to see if you are running the Fed and want to move rates lower this year."

Cox said it's also a positive indicator that the central bank has brought down inflation without tipping the economy into a recession: "Soft landing: runway acquired," he said.

— Alex Harring

Stocks open higher

The three major indexes were up as Thursday's trading day kicked off.

The Dow rose 0.2% shortly after 9:30 a.m. ET. The S&P 500 and Nasdaq Composite added 0.3% and 0.4%, respectively.

— Alex Harring

'Time looks to be running out on the laggards,' BTIG says

Investors looking for a broadening of the rally are running out of time, according to BTIG.

While mega-cap tech stocks have continued to surge higher this year, the majority of the market has continued to fall behind, according to BTIG's Jonathan Krinsky in a Wednesday note. Krinsky said a failure by the laggards this week to make a sustainable bounce could mean the recent stock rally is also near its top.

Broadly speaking, mega-cap tech stocks are all higher this year. Nvidia, for example, has already surged 23% in January. Even Apple, which contended with several notable downgrades this month, is up by 1%.

Compare that with the SPDR S&P Regional Banking ETF, which is down 0.3% this year, or the Ark Innovation ETF, which is off by 11%, Krinsky noted. The VanEck Oil Services ETF is down by 3%, and the iShares U.S. Real Estate ETF is lower by nearly 5%. The small-cap Russell 2000 is off by 3%.

"Whenever markets have divergences, they resolve in one of two ways. Either the reason for the divergence (i.e. the laggards) play catch-up, or the leaders succumb down to the laggards," Krinsky wrote.

"Time looks to be running out on the laggards here, and if the average stock starts to roll over when the super extended leadership names decide to reverse, that's when things get a bit dicey for the broad indices," Krinsky continued. "We think we are nearing that point here."

— Sarah Min

U.S. GDP grows at much faster-than-expected pace

The U.S. economy expanded by 3.3% in the fourth quarter, easily surpassing expectations. Economists polled by Dow Jones had forecast the economy grew by 2% in the fourth quarter.

The report also included encouraging data on the inflation front. The price index for personal consumption expenditures rose 2.7% on an annualized basis, down from 5.9% a year prior. Core PCE increased by 3.2%, down from 5.1%.

The report comes as investors look ahead to possible Federal Reserve rate cuts later this year.

— Fred Imbert

Stocks making the biggest moves before the bell: IBM, Tesla and more

These are the stocks moving the most in premarket trading:

- IBM — IBM shares rallied 7% after topping Wall Street's fourth-quarter estimates.

- Tesla — Shares of the automaker fell 8% after Tesla reported fourth-quarter results that missed estimates on the top and bottom lines and warned that vehicle volume growth may be "notably lower" in the new year.

- Nokia — U.S.-listed shares of the Finnish telecommunications giant jumped 8.5% after Nokia announced a two-year €600 million euro share buyback beginning this quarter.

Read the full list of stocks moving here.

— Lisa Kailai Han

Southwest gains on earnings beat

Southwest added more than 1% before the bell following a better-than-expected financial report for the fourth quarter.

The value-focused airline earned 37 cents per share, excluding items, and $6.82-billion in revenue. Analysts expected just 12 cents per share and $6.75 billion, according to LSEG.

Southwest said it has taken the Boeing 737 Max 7 out of its fleet plans amid regulatory delays.

Shares have jumped almost 8% in 2024, making up some ground after slipping for the prior four years.

— Alex Harring

American advances as earnings positively surprise

American Airlines popped more than 4% in Thursday premarket trading on the heels of a strong quarterly print.

The Texas-based airline said it earned 29 cents per share excluding items on revenue of $13.06 billion in the fourth quarter. That's ahead of Wall Street forecasts, with analysts anticipating 10 cents per share and $13.02 billion in revenue, per LSEG.

American has risen more than 1% this year, adding to 2023's gain of 8%.

— Alex Harring

Blackstone rises on back of earnings report

Blackstone advanced more than 3% in Thursday's premarket after per-share earnings came in better than expected in the fourth quarter.

The investment company posted $1.11 per share, exceeding the consensus estimate of 95 cents from analysts polled by LSEG. But revenue slightly missed the Street's prediction, coming in at $2.54 billion while analysts forecasted $2.57 billion.

Blackstone has dropped nearly 8% so far in the new year, relinquishing some gains after climbing 76.5% in 2023.

— Alex Harring

Humana tumbles on weak guidance

Humana slid more than 14% before the bell on Thursday after the health insurance provider offered weak expectations for full-year earnings.

The company told investors to anticipate approximately $16, excluding items, earned per share in the full 2024 year. That's well below the consensus estimate of $29.10 from analysts surveyed by LSEG.

Humana's guidance overshadowed fourth-quarter revenue, which exceeded the Street's expectations.

Shares have slipped more than 12% in 2024, deepening losses after dropping more than 10% in 2023.

— Alex Harring

Alaska Air rises after earnings

Shares of Alaska Air rose about 1% in the premarket after the airline posted its fourth-quarter results.

The company earned 30 cents per share, excluding items. That exceeded an LSEG estimate of 18 cents per share. Revenue came in line with expectations at $2.55 billion.

This is Alaska Air's first quarterly report since a door plug blew out during an Alaska flight. The company said the grounding of 737 Max 9 jets from Boeing will cost the company $150 million.

— Fred Imbert

Shares of Tesla suppliers and EVs in Asia drop after Tesla's earnings miss

Shares of electric vehicle makers and Tesla suppliers in Asia tumbled after Tesla missed fourth-quarter revenue and profit estimates on Thursday.

EV makers Nio, Xpeng and Li Auto were among the largest losers on the Hang Seng index, with Nio plunging over 7%. Shares of Xpeng and Li Auto lost 6.05% and 4.47% in early trading.

Separately, Tesla suppliers also fell after the automaker's results, with South Korean display manufacturer LG Display slipping over 4%. LG Display is known to supply the car displays for Tesla's Model 3.

Companies along Tesla's battery supply chain registered slightly smaller losses, with LG Energy Solution, Samsung SDI and Panasonic Holdings all down about 2%.

— Lim Hui Jie

South Korea economy grows 1.4% in 2023, Q4 beats estimates

South Korea's economy grew at a faster-than-expected pace in the last quarter of 2023, according to an advance estimate from the Bank of Korea.

Gross domestic product grew 2.2% in the fourth quarter compared with a year ago, more than a Reuters poll estimate of 2.1%.

During the year, data showed South Korea's GDP rose 1.4%.

Data showed exports grew 2.6% in the fourth quarter from the previous three-month period, as shipments of semiconductors increased.

The main Kospi index has lost about 7% since the beginning of the year.

— Shreyashi Sanyal

Market hypothetical: If Boeing was unchanged in 2024, the Dow Industrials would be 308 points higher

The Dow Jones Industrial Average would stand 308 points higher than its current level around 37,806 if shares in Boeing were only unchanged in 2024 rather than down more than 17% in the wake of safety issues surrounding the 737 Max 9.

That's because the Dow is weighted according to share price rather than a company's market value — as is the S&P 500. Boeing closed out 2023 at $260.66 and ended Wednesday at about $214 a share. Every $1 change in the price of any stock in the Dow is worth about 6.6 points.

Similarly, if UnitedHealth Group were unchanged in January, the Dow Industrials would be another 87 points higher. UNH earnings earlier this month showed higher medical costs, which RBC Capital said were above what management had previously forecast due to the popularity of RSV vaccines.

The effect of UNH and Boeing combined, and all other prices being equal, would leave the Dow trading today at more than 38,200.

— Scott Schnipper

Boeing shares fall after FAA halts 737 Max production expansion

Shares of Boeing slid nearly 4% after the Federal Aviation Administration paused the company's 737 Max production expansion, but cleared a path to bring Boeing's Max 9 back into service.

On Wednesday, the FAA said it approved inspection instructions for the Max 9. The regulatory agency grounded the airplanes after a panel blew out of an aircraft on Jan. 5.

Boeing shares have had a rocky start to the year, off nearly 18% in January.

Read more about the FAA's announcement here.

— Leslie Josephs, Darla Mercado

West Texas crude touches 4-week high, gains almost 5% in 2024

West Texas Intermediate crude oil futures for delivery in March gained about 1% Wednesday to $75.09 a barrel, the highest since Dec. 26, 2023, and bringing the year-to-date gain to 4.8%.

February gasoline futures were little changed at $2.2095 a gallon after rising as high as $2.2457, the most since Nov. 30, 2023, and are similarly higher this year by 4.9%.

Other notable commodity price moves pushed the price of March lumber futures to their highest since July 19, 2023, and tin contracts on the London Metal Exchange to their highest since Aug. 11, 2023.

— Scott Schnipper, Gina Francolla

Dow futures rise, boosted by IBM earnings

Futures tied to the Dow Jones Industrial Average were higher on Wednesday, with quarterly results from technology company IBM helping lift the index.

Dow futures gained 73 points, or 0.1%. S&P 500 Futures climbed 0.04% while Nasdaq 100 Futures hovered near the flat line.

— Brian Evans