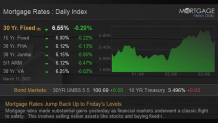

Mortgage rates are falling after last week’s bank failures.

According to Mortgage News Daily, this week a 30-year fixed mortgage rate is down .5 % from last Friday. That means if you put 20% down on a $500,000 home today you would save approximately $128 on your monthly payment compared to last week. The current 30-year fixed mortgage rate is at 6.55% Wednesday compared to 7.05% last Friday.

“Since home prices are down and interest rates are looking great compared to where we’ve been, this is a great market for first-time home buyers,” said Alexis Arrington a mortgage loan officer with San Diego Funding.

Get top local stories in San Diego delivered to you every morning. >Sign up for NBC San Diego's News Headlines newsletter.

Home prices were decreasing after the Federal Reserve raised interest rates to try to curb inflation. While home prices might begin to increase, if rates continue to decline, there could be a perfect window of opportunity for real estate experts to say to buy this spring, while prices and rates are still low.

“Just in the last 30 days, a lot more condos have been listed, so I think what that means is that we’re seeing a lot more move-up buyers, who are saying, 'Hey if the rates are going to be so low then maybe I can now get into that house and get out of that condo I’m currently in,”' said Jessica Tangen with Big Block Realty who says she’s already seeing houses going off the market quicker right now than they were last month.

Economist Alan Gin with the University of San Diego says that investors are anticipating that the Federal Reserve might not raise interest rates next week because the economic metrics are doing better and because of the banks collapsing. He says this has been helpful for bonds.

Local

“There’s been a big surge in recent days in terms of bond prices. When bond prices go up, that causes interest rates to go down, that means all interest rates go down including mortgage rates,” Gin said.