The S&P 500 fell Tuesday, weighed by concerns over rising Treasury yields ahead of a key speech later this week from Federal Reserve Chairman Jerome Powell, as well as declines in banking and retail shares.

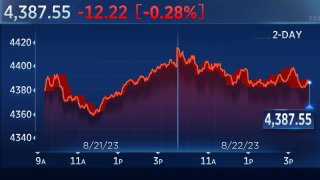

The S&P 500 edged 0.3% lower to 4,387.55, while the Dow Jones Industrial Average slid 174.86 points, or 0.5% to 34,288.83. The tech-heavy Nasdaq Composite eked out a small gain to close at 13,505.87. Nvidia, which is slated to report earnings Wednesday, ended the session down 2.9% — erasing an earlier gain.

Several regional and larger banks fell after S&P Global cut credit ratings and revised its outlook for multiple U.S. banks on Monday, citing "tough" operating conditions. The financial sector ended Tuesday down 0.9%, making it the worst-performing sector of the S&P 500. KeyCorp and Comerica dropped 4.1% each. Big bank JPMorgan Chase also fell 2.1%.

Get top local stories in San Diego delivered to you every morning. >Sign up for NBC San Diego's News Headlines newsletter.

Dick's Sporting Goods and Macy's fell by 24% and 14%, respectively, on cautious full-year forecasts, also leading the SPDR S&P Retail ETF lower. Dow member Nike slid more than 1% for its ninth consecutive daily loss

Wall Street has been focused on the bond market after the benchmark 10-year Treasury yield hit its highest level since 2007 this week. The 10-year yield eased slightly Tuesday to 4.33%.

"I think [the market] is kind of wavering right now as the 10-year yield is hovering right around those October highs," Adam Turnquist, chief technical strategist at LPL Financial said. "We're watching for an official breakout on the 10-year. ... I think if we start moving higher, that's certainly a warning sign for maybe a little bit deeper pullback in equity markets."

Money Report

While Turnquist said he is not bearish on stocks, he thinks "we're in the pullback phase of a bull market." The strategist named the industrial sector as his top pick.

Crossmark Global Investments' Victoria Fernandez similarly expects a continuing pullback in the market, which she said will be influenced by climbing yields and a more cautious consumer.

"I think we're gonna see higher yields bite a little bit," said Fernandez, the firm's chief market strategist. "Now that we're through earnings, it's the macro story that's going to be driving a lot of what we see in market volatility, and positive macro stories are really a double-edged sword because all that does is tell the Fed that their financial conditions are not tight enough."

Investors are anticipating Powell's speech at the Kansas City Fed's annual economic symposium in Jackson Hole, Wyoming this Friday.

Stock indexes end Tuesday mixed

The broad-based S&P 500 ended Tuesday down 0.28%, while the Dow Jones Industrial Average lost 174.86 points, or 0.51%.

The tech-heavy Nasdaq Composite inched up Tuesday, gaining 8.28 points, or 0.06%.

— Pia Singh

Hasbro is the leading stock in the S&P 500

Hasbro was the top performer in the S&P 500 Tuesday afternoon.

Shares advanced 6.9% in midday trading after Bank of America raised its price objective on the toymaker. The Wall Street firm said Hasbro will get a boost in 2024 from royalties collected from its recent digital game launch in Monopoly Go.

"Search interest in Monopoly Go has already reached 75% the level of Coin Master's peak," analyst Jason Haas wrote in a Tuesday note. "If Monopoly Go generates $500mn of revenue in its first year, we estimate this will contribute $60mn of revenue for Hasbro or $0.33 to EPS, largely benefiting 2024."

The analyst raised his price objective to $90 from $85. That implies the toymaker can jump 42% from Monday's close.

— Sarah Min, Michael Bloom

Higher long-term rates could complicate a soft landing, says Apollo's Torsten Slok

Yields have moved sharply up over the last two weeks, with the 10-year Treasury yield hitting its highest levels since November 2007. Apollo Chief Economist Torsten Slok warns that this upward trend could make it tricky for the Federal Reserve in balancing both its inflation reduction goal and economic stability.

"The challenge with what's going on is that when long rates begin to do the job, it becomes a lot more tricky for the Fed. The Fed can control short rates. But with long rates now going up. ...You have significant risk," Slok told CNBC's "Squawk on the Street" on Tuesday.

The economist cited the recent Fitch downgrade on the U.S., quantitative tightening and yield curve control exit speculation.

"So the bottom line still is the same — maybe that if the Fed is beginning to lose a little bit [of] control, then the long rates rates moving up is indeed a bit more challenging, in terms of getting the economy to that soft landing that we all would like to see," Slok said.

— Hakyung Kim

Oil supply could outpace demand, Citi commodities head says

Investors should be bearish on oil, according to Ed Morse, Citi Research's head of global commodities.

A range of countries have been able to grow their oil production, he said. Meanwhile, he said demand likely won't keep up.

"The supply side is probably more important than the demand side at the moment," he said on CNBC's "Power Lunch." "We can't underestimate what's happening on supply."

— Alex Harring

UBS says logistic stock is worth snapping up

Logistics stock GXO is worth buying given its resilience and growth, UBS said Tuesday.

Analyst Thomas Wadewitz initiated coverage of the stock as a buy rating. His price target implies shares could rally 18.4% over the next year.

"Tight labor markets and continuing advancements in robotics drive demand for warehouse solutions with automation," Wadewitz said in a note to clients initiating coverage. "GXO's strong skill set and scale support an expanding footprint with many of its large, global customers and business with new customers."

The bullish call comes during a strong year for the stock, with shares up 45.5% since 2023 began.

— Alex Harring

Financials sector drags Tuesday, while real estate and utilities gain

Real estate and utilities outperformed the S&P 500 on Tuesday, inching up 0.4% compared to the broad market index's 0.3% decline. Digital Realty Trust and Iron Mountain led the real estate sector's gains, both up more than 2%.

Financials was the most-declining sector, trading 0.8% lower Tuesday, with banks pulling down the group after S&P Global's downgrade of several regional lenders. Regions Financial lost 5.1% and Zions Bancorp shed, while KeyCorp and Comerica dropped 4%. Charles Schwab dropped 4.8% on news that the firm is looking to raise debt in the bond market.

Energy and consumer staples were also lagging the market. Target's stock price shaved off 3% and Estee Lauder dropped 1.8%. Other retailers trading in the red Tuesday include food product distributor Sysco, Dollar General and spice maker McCormick & Company.

— Pia Singh

Wedbush initiates coverage of Alphabet, calls search giant a 'long-term winner' in digital advertising

Wedbush Securities is getting more bullish on the e-commerce and digital advertising sector, and naming Alphabet as one of its top picks.

The firm initiated coverage of the search giant with an outperform rating, citing the company's strong free cash flows, strong long-term positioning within the generative AI cycle, and ability to navigate a changing digital advertising environment.

"We believe Google is a long-term winner within the digital advertising industry with broad exposure and durable market share of overall media spending," wrote analyst Scott Devitt.

The firm placed a $160 price target on shares, reflecting about 25% upside from Monday's close. The stock gained 0.6% on Tuesday.

— Samantha Subin

Bank of America clients bought $4.4 billion in equities last week

For the third straight week last week, Bank of America's clients were net buyers of U.S equities, putting $4.4 billion to work in the market, the firm said.

"Even though clients bought stocks and ETFs, single stock inflows have been much larger than ETF inflows for the last three weeks and cumulatively YTD, by the widest spread in our data history," Jill Carey Hall wrote in a note Monday.

Clients bought both large and small caps, with inflows into small caps ongoing for the past 8 weeks after extreme outflows in the first half, she said. Health care led the single stock inflows, the second largest inflows in Bank of America's data history since 2008.

— Michelle Fox

Dick's Sporting Goods shares plunge Tuesday on earnings miss

Dick's Sporting Goods' stock tumbled 23.5% in afternoon trading after the company reported a 23% profit drop and slashed its earning guidance for the year.

In a rare miss for the company, earnings per share for its fiscal second quarter came in at $2.82, well below the $3.81 expected from analysts polled by Refinitiv. Revenue was $3.22 billion, missing the $3.24 billion consensus estimate. Dick's said it has seen an uptick in retail theft and expects it to get worse before it gets better.

The athletic goods retailer said it now expects earnings of $11.33 to $12.13 per share for the year, compared with previously issued guidance of $12.90 to $13.80. Despite the profit loss during the quarter, the company still expects gross margins to increase for the full year compared with 2022.

—Michelle Fox, Gabrielle Fonrouge

JPMorgan upgrades manufacturing giant Emerson Electric

JPMorgan upgraded engineering stock Emerson Electric on Tuesday, while analyst Stephen Tusa noted the company is no the verge of a meaningful breakout.

"After a decade long rolling reset, visibility around positive earnings revisions is now as good as its been since the 2003-2008 super cycle," Tusa said in a note. "We see an attractive GARP [growth at a reasonable price] set up as the dust settles on what should be close to a final round of mostly dilutive portfolio moves, but where we think the underlying quality of core value driving franchises is underappreciated," Tusa said.

Emerson Electric stock added 0.8% in Tuesday afternoon trading. CNBC Pro subscribers can read the full story here.

— Brian Evans

Credit card delinquencies on the rise

Credit card delinquencies are creeping back toward pre-pandemic levels and have already hit new highs for smaller banks, according to the Wells Fargo Investment Institute.

"Credit card and auto loan delinquencies are increasing. In fact, credit card delinquencies at banks not in the top 100 in assets ... have increased to a record, which also raises stress on small- and medium-sized banks," the group said in a note to clients on Tuesday.

This indication of a weakening consumer supports the idea that a recession is coming, the note said.

"The economy still has a cash cushion, but many consumers are exhausting their credit, while income growth has slowed sharply. Our outlook remains for a short, moderate recession and then recovery for most of 2024 and likely into 2025," the note said.

— Jesse Pound

Stocks making the biggest moves midday: Dick's Sporting Goods, Macy's and more

Here are the companies making the biggest moves during midday trading:

- Dick's Sporting Goods — The retail stock tumbled nearly 24% after Dick's reported a rare earnings miss and slashed guidance for the year, thanks in part to an uptick in store theft.

- Macy's – The department store stock sank 11% after Macy's reiterated its cautious full-year outlook.

- Lowe's – Lowe's shares gained 4% after the home improvement retailer topped earnings expectations and reiterated its full-year guidance.

Read the full list here.

— Samantha Subin

Wedbush adds Amazon to best ideas list

Wedbush thinks Amazon has more room to run thanks to an underappreciated core business segment.

The firm added the tech giant to its Best Ideas List in a Monday note from research analysts. Shares are up 0.2% on Tuesday.

"With comp issues fading and capacity utilization rising, Amazon's core business is now well positioned with an industry-leading fulfillment infrastructure that is delivering 4x as many same-day or next-orders in the U.S. versus 2019 against an improving backdrop for eCommerce as the secular shift online resumes," the note said.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Stocks will 'hang in there' and rise by end of year, Yardeni says

Yardeni Research president Ed Yardeni said Tuesday on "Squawk Box" that he expects the stock market to rebound from its August slump and finish the year higher.

"I think the market's going to hang in there. I think right now we're in a pullback that may last through the end of September, the traditional seasonally weak period. But I think a year-end rally will bring the S&P 500 back to something like 4,600," Yardeni said.

The S&P 500 has dropped about 4% in August as Treasury yields have risen, closing on Monday at just under 4,400. Yardeni said that he viewed the rise in Treasury yields as a sign that the market was beginning to buy in to the U.S. economy being resilient, which should help corporate earnings and stock prices.

— Jesse Pound

Charles Schwab shares move lower on reported debt offering

Charles Schwab shares tumbled more than 4% in trading Tuesday after Bloomberg reported the financial services firm is looking to raise debt in the bond market.

Late Monday, the company, which operates a brokerage and a banking unit, reported plans to cut jobs and review its real estate portfolio in an effort to cut its annual costs by $500 million.

This would be the second time the company is raising money since a banking crisis shook the industry in March.

—Christina Cheddar Berk

Retail ETF poised for worst day since May as Dick's sees record fall

The SPDR Retail ETF (XRT) is on pace for its worst day since May, weighed on by a record-setting tumble in Dick's Sporting Goods and a crop of other down stocks.

The ETF has fallen 1.8%. If that holds through the session close, it would be the worst performance since May 31, when the fund tumbled 3%.

Dick's is on pace for its worst day since it went public in 2002 with a slide of 23.2% on the back of its weak earnings report. Macy's, Academy Sports, Kohl's and Nordstrom were also all among the worst performers in the ETF, with all down at least 5%.

— Alex Harring

Business indexes show weakness in August

Business surveys from two Federal Reserve district showed activity remained sluggish in August.

The Richmond Fed's Business manufacturing survey turned in a reading of -7 for the month. That was up slightly from the -9 in July and the Dow Jones estimate for -10. However, the gauge represents the difference between companies seeing expansion against contraction, so it still shows weakness.

Separately, the Chicago Fed's Survey of Economic Conditions turned in a reading of -23, which was better than July's -31. The reading is not a straight diffusion index like Richmond's, but the level suggests "that economic growth was below trend," the central bank said in an accompanying narrative.

—Jeff Cox

Home sales slid in July as prices increased

Home sales declined at a faster pace than expected in July as prices pushed higher, the National Association of Realtors reported Tuesday.

Existing sales dropped 2.2% from June, against the Dow Jones estimate for a 0.2% decline. Sales totaled 4.07 million, against the estimate for 4.15 million, and were off 16.6% from a year ago.

The median sales price increased 1.9% to $406,700, while unsold existing homes rose 3.7% from June to the equivalent of 3.3 months of supply.

—Jeff Cox

Bank of America begins coverage of Madison Square Garden Entertainment

Bank of America thinks Madison Square Garden Entertainment is the go-to play for investors looking for exposure to an "iconic" venue.

The firm initiated coverage of Madison Square Garden Entertainment with a buy rating on Tuesday. Shares added 2.1% in morning trading.

"Post its spinoff from Sphere, we view MSGE—owner of iconic venues including Madison Square Garden and The Chicago Theatre—as an attractive opportunity to own a growth-oriented, pure-play live entertainment company," analyst Peter Henderson said.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Stock indexes open higher Tuesday

The S&P 500 and the Nasdaq Composite began Tuesday's trading session higher. The broad-based index gained 0.4% and the tech-heavy Nasdaq advanced 0.7%, respectively, continuing yesterday's gains. The Dow Jones Industrial Average opened just above flat.

The yield on the 10-year Treasury was up 4.35%.

— Pia Singh

Charles Schwab announces job cuts, office closures

Charles Schwab will be reducing its headcount in addition to closing or downsizing certain corporate offices, according to a recent filing submitted to the U.S. Securities and Exchange Commission.

The company said it aims to realize at least $500 million of incremental annual run-rate cost savings. To do so, it acknowledged it will likely have to incur exit costs ranging from approximately $400 million to $500 million.

The number of planned job cuts was not disclosed. Premarket shares gained more than 0.3% on Tuesday after closing 0.2% lower on Monday.

— Hakyung Kim

Stocks making the biggest moves premarket

Check out the companies making headlines before the bell:

- Fabrinet — Fabrinet surged 21% after its fiscal fourth-quarter results late Monday topped analysts' estimates. The advanced manufacturing services company posted non-GAAP earnings of $1.86 per share, greater than the $1.80 earnings per share expected by analysts polled by FactSet. Revenue came in at $655.9 million, greater than the $641.4 million consensus estimate.

- Dick's Sporting Goods — Shares plunged nearly 20% after the retailer reported an earnings miss and cut guidance for the year, due in part to an increase in retail theft. Earnings per share for its fiscal second quarter came in at $2.82, well below the $3.81 expected from analysts polled by Refinitiv. Revenue also fell short.

- AppLovin — Shares climbed 4% in premarket trading after Jefferies upgraded the marketing stock to buy from hold. Jefferies said the company should continue to win market share and grow its software segment.

Read the full list here.

— Sarah Min

J.P. Morgan's chief market strategist calls for 'soft/no landing' scenario

Earnings estimates are still higher than they should be, according to J.P. Morgan's Marko Kolanovic.

"The consensus 2024 EPS growth rate of 12% appears too optimistic given an aging business cycle with very restrictive monetary policy, still rising cost of capital, lapping of very easy fiscal policy, eroding consumer savings and household liquidity, low unemployment rate, and increasing risk of a recession for some of the largest economies abroad (e.g., China, Germany)," said Kolanovic, the firm's chief market strategist and global research co-head.

Kolanovic called for a "soft/no landing" as his new base case, noting that investor expectations, market positioning and equity valuations have moved up compared to where they were at the start of this year. Companies are seeing softening demand and pricing power with ongoing margin pressure, he said.

— Pia Singh

Jefferies upgrades AppLovin

Jefferies upgraded shares of application marketing company AppLovin in a Monday note thanks to a growing market share. Shares were 3.8% higher in premarket trading.

"Investors should have more confidence in sustainable growth (despite a weak mobile market), continued share shift, optionality on adjacent markets, and reasonable valuation. It's better late than never, in our view, despite the extreme positive performance for AppLovin, +263% vs. NASDAQ's +27%," analyst Andrew Uerkwitz said.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Here are three stocks moving on earnings Tuesday morning

- Lowe's gained more than 2% premarket after the home improvement retailer reported second-quarter results Tuesday that topped Wall Street's earnings estimates, but fell slightly short of expected sales. The company reaffirmed its full-year forecast. Read here for more.

- Shares of Zoom gained 1% after beating expectations on the top and bottom lines. The video-calling software provider also pushed up full-year guidance, but is moving at a slower pace than it was two years ago, when its revenue multiplied during the pandemic. Read here for more on Zoom's earnings.

- Dick's Sporting Goods plunged nearly 19% premarket after the retailer posted a profit drop for its second fiscal quarter and slashed its earnings outlook for the year. It's a rare miss for the company. Read here for more.

— Pia Singh

Microsoft sends new Activision Blizzard takeover deal to U.K. regulators

Microsoft submitted a revised takeover deal of Activision Blizzard to British regulators after the first proposal was rejected. The new deal will be investigated by the Competition and Markets Authority, with a decision deadline set for Oct. 18. Shares of the tech giant climbed 0.6% in the premarket.

— Fred Imbert

Baidu pops on earnings beat

Baidu shares popped more than 4% after the Chinese tech company reported better-than-expected earnings and revenue for the second quarter.

CEO Robin Li pointed to "revenue and profit growth" for the company's core business, "driven by the solid performance of online marketing business and operating leverage."

— Fred Imbert

People hesitant to embrace the Monday's rally, Vital Knowledge says

Monday's rally led the Nasdaq Composite to snap a four-day losing streak, but there's still some skepticism, according to Adam Crisafulli of Vital Knowledge.

"The stabilization/rebound in US equities is entering day 3 so far today and while sentiment is starting to turn the corner (bears are becoming nervous following the huge Mon rally in tech), people remain hesitant to fully embrace the tape ahead of Nvidia (Wed night) and Powell (Fri morning)," Crisafulli said in a note.

He also noted that stocks may be getting a boost after a Wall Street Journal article hinted the Fed "might tolerate a slower path to its 2% inflation target (or even countenance an increase to that target) rather than an aggressive tightening stance that would severely undermine the economy.

"The knee-jerk implications of the report are bullish, BUT we caution that this strategy will only work so long as inflation remains on a downward trajectory," Crisafulli wrote.

— Fred Imbert, Michael Bloom

Europe stocks open higher

European stock markets opened higher before extending gains in early trade, with the Stoxx 600 index up 0.9% at 9:07 a.m. BST.

All sectors posted gains and tech stocks were 2% higher, following upbeat sessions in the U.S. and Asia-Pacific markets.

— Jenni Reid

SoftBank shares climb after Arm files for listing

Shares of SoftBank Group climbed as much as 3.36% on Tuesday after news that its chip unit Arm filed for a Nasdaq listing.

Arm did not disclose a share price and therefore has no valuation yet for the listing, but Reuters said that it is expected to be "the largest of the year."

Shares of SoftBank pared gains later in the session and are currently up 2.16%.

— Lim Hui Jie

South Korea's consumer sentiment weakens for first time since Feburary.

South Korea's consumer sentiment weakened in August for the first time in six months, according to a survey from the Bank of Korea.

The consumer sentiment index fell to 103.1 from 103.2 the previous month. A reading above 100 means that optimists outnumber pessimists in the survey, and vice versa.

Consumers' assessment of current domestic economic conditions, as well as their outlook for future domestic economic conditions worsened in July.

However, sentiment concerning future living standards and future household income improved from July, slightly offsetting the decline.

— Lim Hui Jie

Hong Kong inflation rate slows more than expected in July

Hong Kong's inflation rate slowed more than expected in July, coming in at 1.8% compared to the 2% expected by economists polled by Reuters. The figure is also lower than the 1.9% seen in June.

Hong Kong's census and statistics bureau noted that the largest increase in prices in July were recorded for alcoholic drinks and tobacco, which jumped 18.4% year-on-year.

Prices of electricity, gas and water (up 9.9% year-on-year), as well as clothing and footwear (up 6.6%) rounded off the top three sectors that saw the largest increases in July.

On the other hand, prices of durable goods and basic food fell on a year-on-year basis in July, decreasing 3.3% and 0.5% respectively.

— Lim Hui Jie

Expect Marvell Technology earnings to come in line with expectations, analysts say

Some on Wall Street are cautioning against getting too excited about Marvell Technology earnings on Thursday.

Analysts at JPMorgan and Raymond James in notes to clients on Monday said that they both expect the company's fiscal second quarter to come in line with what they've been expecting. JPMorgan is overweight on the stock, while Raymond James has an outperform rating.

"We see the current headwinds to be largely cyclical/ short-term in nature, and we believe the company continues to execute on its LT growth initiatives and should drive above-industry growth mid/longer-term," said JPMorgan analyst Harlan Sur.

Shares climbed nearly 4% in Monday's session.

— Alex Harring

Stocks making the biggest moves after hours

Here are the stocks making the biggest moves in extended trading.

Zoom — Shares jumped nearly 4% after the company reported an earnings and revenue beat during its fiscal second quarter. Zoom posted $1.34 earnings per share on $1.14 billion in revenue. Analysts had estimated $1.05 earnings per share on $1.12 billion in revenue, according to Refinitiv. Meanwhile, the company's current-quarter guidance came slightly below analyst expectations.

Fabrinet — Shares of the advanced manufacturing services company surged more than 18% after its fiscal fourth-quarter results beat both top and bottom lines. The company's CEO Seamus Grady said very strong growth in data communications revenue and new AI products, led the company to record performances in the 2023 fiscal year.

— Hakyung Kim

Stock futures open lower

U.S. stock futures inched down Monday.

Dow Jones Industrial Average futures shed 27 points, or 0.08%. Meanwhile, S&P 500 and Nasdaq 100 futures declined 0.1%.

— Hakyung Kim