Stocks fell on Wednesday after Federal Reserve chairman Jerome Powell said the central bank likely wouldn't be ready to cut rates in March.

The Dow Jones Industrial Average fell 317.01 points, or 0.82% to close at 38,150.30. The S&P 500 fell 1.61% to 4,845.65. The Nasdaq Composite lost 2.23% to finish the session at 15,164.01.

Wednesday's session was markedly terrible for the major averages. It was the worst performance for the Dow since December. For the S&P 500, it was the worst day since September, and since October for the Nasdaq.

"I don't think it's likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that," Powell told reporters on Wednesday. The major averages hit their session lows shortly after the comments.

Get top local stories in San Diego delivered to you every morning. >Sign up for NBC San Diego's News Headlines newsletter.

Traders were closely watching the Fed announcement for signs of when the central bank would begin to cut rates. Powell seemingly threw cold water on the markets expectation for a March cut, noting further encouraging data on inflation was needed.

Still, the central bank did do something traders wanted, which is remove the part of the statement that signaled the central bank still had a tightening bias. The Fed removed a phrase that referred to "additional policy firming."

"We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint, at some point this year," added Powell.

Money Report

Treasury yields seesawed, with the benchmark 10-year yield last trading around 3.9%.

Alphabet dropped more than 7% for its worst day since Oct. 25 as disappointing ad revenue overshadowed better than expected earnings and sales. Stock in peer tech firms Microsoft and AMD slipped nearly 3% each on lower-than-expected forward guidance after posting quarterly results.

Shares of Boeing climbed more than 5% following quarterly results that beat analyst estimates on the top and bottom line. The company has been plagued by recent issues tied to its 737 Max 9 which has pushed Boeing to focus on safety moving forward, Boeing CEO Dave Calhoun said.

Wednesday's declines ate into the markets' monthly gains, but all three major averages ended January on a positive note. The S&P 500 added 1.6%, while the Dow advanced 1.2%. The Nasdaq gained 1%.

Bitcoin slips with stocks after Fed decision

Bitcoin fell as much as 2% on Wednesday afternoon as Fed Chair Jerome Powell said a rate cut at the central bank's March meeting may be "unlikely."

The price of the flagship cryptocurrency was last lower by 1.73% and trading at $42,884.05, according to Coin Metrics. Ether fell 3% to $2,302, while Solana dropped 5% and the token tied to Cosmos lost 4%.

While traditional investors see bitcoin as a young, risky asset crypto investors see it as a store of value compared to smaller and riskier altcoins.

"Although inflation has come down, the Fed signaled today that it has not yet secured price stability, and will hold off cutting rates for now," said Zach Pandl, head of research at Grayscale Investments. "This will likely strengthen the dollar over the short-term, and may be a temporary headwind for bitcoin."

— Tanaya Macheel

These are January's biggest Nasdaq gainers

Technology stocks rallied to start 2024, pushing up the tech-heavy Nasdaq Composite and Nasdaq-100 more than 2% each.

As January comes to a close, Nvidia's poised for the biggest gains in the concentrated Nasdaq-100, with shares up more than 24% and on pace for their best month since May 2023. Other significant winners include Netflix, CrowdStrike and Palo Alto Networks, with gains exceeding 16% each.

Advanced Micro Devices and ASML are up 12% and 15.5% on the month, while Marvell Technology and Meta Platforms have rallied 11.8% and 12.7%, respectively.

Tesla is the biggest loser in the index and poised for a 23% loss.

— Samantha Subin

Communication services lead S&P 500's sector losses

Shares of Alphabet declined 7% Wednesday, pulling back the communication services sector to lead the S&P 500's losses.

Communication services fell 3%. Meta shares also were down 1% for the day.

Information technology was the second-biggest losing sector, losing 1.2%. Teradyne stock fell 7.6%, followed by Arista Networks and Roper Technologies down nearly 4%.

— Hakyung Kim

Put-call ratio can signal market consolidation ahead, research firm says

A short-term indicator can indicate a market breather on the horizon, according to Wolfe Research.

Managing director Rob Ginsberg said the five-day moving average of the ratio between puts and calls has fallen into what he calls a "complacency zone." For reference, investors buy a call option when they anticipate a stock's price will rise, or get a put when they foresee shares tumbling.

In this environment, he said investors should prepare for a short-term correction ahead.

"We're inclined to take some profits and tighten stops," he told clients.

While Ginsberg said there have been false signals in recent history, it is usually "a pretty good indicator of a short-term breather or consolidation on the horizon."

— Alex Harring

The ‘Maradona Theory of Interest Rates’ is alive and well, BofA says

The Federal Reserve is making inroads in its fight against inflation by taking a page out of legendary soccer player Diego Maradona's playbook, Bank of America noted.

"The Maradona Theory of Interest Rates is alive and kicking," BofA economist Claudio Irigoyen wrote. "Let the market do de facto easing but keep the optionality open. That explains why the Fed might find optimal reasons not to push back strongly."

The theory was first introduced by former Bank of England Governor Mervin King in the 2000s, and it alludes to Maradona's second goal against England in the 1986 World Cup — which many regard as the greatest goal of all time.

"He started running towards the goal in the midfield, dribbled six players including the goalkeeper and scored. The most striking feature of that masterpiece was that Maradona moved in a straight line towards the goal," Irigoyen said. "Why did he get away with it? Because England defenders expected him to move either to the right or to the left, so given the defender's expectations, it was optimal for him to move forward in a straight line."

"This is the way central banks conduct monetary policy sometimes. By letting markets believe they will move in a certain direction … they let markets do the easing/tightening for them."

— Fred Imbert

10-year yield holds below 4% after Fed statement

Bond yields trimmed their losses after the Fed released its updated statement, but the 10-year Treasury yield stayed below the 4% market.

Shortly before 2:30 pm ET, the 10-year yield was at 3.98%, down about 8 basis points on the day. The 2-year Treasury yield was down nearly 10 basis points to 4.262%.

— Jesse Pound

Fed keeps interest rates unchanged

The Fed kept interest rates unchanged, as was widely expected. However, the central bank indicated it is not ready to start lowering interest rates just yet.

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent," the statement said.

— Fred Imbert

Oil on pace for first monthly gain since September as Middle East on the brink

Oil prices are on pace to book the first monthly gain since September as the U.S. and Iran stand on the brink of a more direct confrontation in the Middle East.

U.S. crude and global benchmark Brent are up 5.95% and 6.09% respectively for the month, though they were trading lower Wednesday on weak economic data out of China.

The West Texas Intermediate contract for March was last down $1.77, or 2.27%, to trade at $76.05 a barrel. The Brent contract for March was trading at $81.77 a barrel, down $1.10 or 1.33%.

China factory activity contracted for the fourth consecutive month raising demand concerns, while U.S. crude inventories rose by 1.2 million barrels last week.

Tensions in the Middle East are simmering with the U.S. preparing retaliatory strikes in response to the death of three U.S. soldiers in a drone attack by Iran-allied militants.

President Joe Biden says he holds Iran responsible for providing weapons to the militants. Iran has warned that it would take "decisive action" in response to U.S. strikes.

"The spreading conflict in the Middle East remains the most visible and growing risk for energy markets," Natasha Kaneva, head of global commodities research at JPMorgan, told clients in a research note Tuesday.

— Spencer Kimball

Bank of America sees Meta beat expectations for earnings

Bank of America expects Meta Platforms to top expectations for earnings on the back of its artificial intelligence momentum.

The Wall Street firm maintained its buy rating on Meta Tuesday. The tech firm is set to report numbers Thursday after the bell.

"Ad checks have been positive on Reels momentum and AI benefits, and YouTube reported a 4pt q/q headline acceleration in y/y growth (3pts q/q unrounded), which supports our view that Street estimates for modest q/q rev. deceleration have upside," Bank of America said.

The bank remains bullish on the stock, saying Meta's strong AI assets could lead to positive product surprises and revenue momentum in 2024.

— Yun Li

Stocks making the biggest moves midday

Check out some of the companies making headlines in midday trading.

Boeing — The aircraft maker jumped more than 5% after its losses from the end of last year came in lower than expected. Boeing reported an adjusted loss per share of 47 cents on revenue of $22.02 billion. Analysts had expected losses of 78 cents per share on $21.1 billion in revenue, according to LSEG, formerly known as Refinitiv. Its CEO said now is "not the time" for financial targets as the company deals with fallout from its fuselage panel blowout incident earlier this month.

Alphabet — Shares fell 6.3% after the company posted disappointing fourth-quarter advertising revenue. Late Tuesday, Alphabet posted beats on both top and bottom lines, but its advertising revenue of $65.52 billion fell below analysts' forecast of $65.94 billion, per StreetAccount.

Paramount Global — Shares of the media company popped about 7.5% on news that billionaire entrepreneur Byron Allen submitted a takeover offer to buy all outstanding shares. The deal values Paramount at about $30 billion, including debt and equity.

Read the full list here.

— Brian Evans

Novo Nordisk results show brisk demand for Wegovy as supplies improve, analysts say it bodes well for sector

Eli Lilly shares hit a fresh high in trading Wednesday, in the wake of strong results from Novo Nordisk. The two companies are leaders in the emerging obesity drug space, with Eli Lilly recently launching Zepbound, a GLP-1/GIP drug also known as tirzepatide, into the market. Novo Nordisk said it sees its 2024 sales growing 18% to 26% from 2023 as supplies of its popular drugs Wegovy and Ozempic increase.

"Readthrough to LLY is limited as higher share split for Wegovy may not come at their cost given tirzepatide's LT supply remains constrained," wrote Mohit Bansal, an analyst at UBS. "Higher market growth under NVO guide could be taken positively for AMGN, however, as a potential third player with AMG133."

Amgen recently shared early data from its phase 1 study of MariTide, or AMG133, its experimental obesity drug. Like Lilly, Amgen's stock also hit a 52-week high in trading earlier, but shares were recently trading virtually flat from Tuesday.

Novo Nordisk's stock was holding on to gains and was recently up 3.8%. The company also shared positive updates about its pipeline, which includes a next-generation weight loss drug.

—Christina Cheddar Berk

Tech bubble may finally be deflating this week

Tech stocks propelled 2023's spectacular end-of-year rally, but the bubble may finally be on the verge of deflating.

Information technology and communication services are the only two S&P 500 sectors down for the week, having respectively slid 1.6% and 2.9%.

"Magnificent 7" members Alphabet and Apple have respectively lost nearly 7% and 3.8% this week. Other tech titans poised to end the week in the red include Applied Materials (-3.1%), Taiwan Semiconductor (-3.4%), Cisco (-2.9%) and Intel (-2.9%).

— Lisa Kailai Han

Dow heads for winning month despite divergence in member stock performances

The Dow is on pace to finish January with gains of more than 2%, as a group of rallying stocks outweighed a handful of sharp sell-offs.

More specifically, the blue-chip index is tracking to end the month, which concludes with Wednesday's closing bell, 2.2% higher. About two-thirds of the 30 stocks that comprise the average are tracking for gains.

IBM has led the index higher this month, climbing nearly 14%. The technology stock took a leg up on the back of a better-than-expected earnings report last week.

Verizon and Travelers were the next biggest gainers with advances of more than 12% each. Merck followed, rising more than 11%.

But those gains were mitigated by big losses seen elsewhere. Most notably, Boeing has dropped more than 18% in the month amid the 737 Max 9 crisis, making it the worst performer in the index.

Intel was the next biggest loser with a 15% tumble. 3M and Walgreens also weighed on the index, posting slides of more than 12% each.

— Alex Harring

New York Community Bancorp plunges 46% intraday, driving down regional banks

New York Community Bancorp plunged as much as 46%, down $4.80 to a low of $5.58 in early trading Wednesday, the largest one-day decline since it went public in 1993 and helping drive down the SPDR S&P Regional Banking ETF as much as 5.6%.

In more recent trading, the KRE was off 3.8%, on course for its worst one-day loss since falling 5.5% last May 4.

NYCB, viewed as a beneficiary of last spring's banking crisis when it took over the failed Signature Bank, said premarket Wednesday that it suffered an adjusted fourth quarter loss of $193 million, took a $552 million provision for credit losses and slashed the quarterly dividend to 5c a share from 17c previously.

Other notable declines among regional banks included Valley National, down 11.3%, Bank OZK, lower by 5.3% and BankUnited, off 5.2%.

— Scott Schnipper, Gina Francolla

Treasury lists increases for debt auctions

The Treasury Department will be increasing the size of its debt auctions in the coming quarter, though the total amount it seeks to raise is less than previously announced.

Officials with the department on Wednesday listed the upcoming auction increases as follows: 2- and 5-year by $3 billion per month, the 3-year by $2 billion per month, and the 7-year by $1 billion per month. Cumulatively, that means the auction sizes of the 2-, 3-, 5-, and 7-year respectively will rise by $9 billion, $6 billion, $9 billion and $3 billion by the end of April.

For the quarter, Treasury will be borrowing $760 billion, which is below the $815 billion initially announced in October. That comes despite the government running a deficit of more than $500 billion in the fiscal first quarter of 2024. The upcoming auctions in mid-February will total $121 billion.

Treasury officials also said they do not foresee any further increases in auction sizes.

—Jeff Cox

Nasdaq opens lower, tech slides after Alphabet earnings

The Nasdaq Composite opened lower on Wednesday, weighed down by a slide in Alphabet and Microsoft stock.

The tech-heavy composite fell 1.1%, while the S&P 500 pulled back 0.5%. The Dow Jones Industrial Average gained 64 points, or 0.1%.

— Brian Evans

Employment cost index rose less than expected in Q4

Costs for wages and salaries increased less than expected in the fourth quarter of 2023, the Labor Department reported Wednesday.

The employment cost index rose 0.9% for the October-through-December period, down from 1.1% in Q3 and the smallest increase since the second quarter of 2021. Economists surveyed by Dow Jones had been looking for growth of 1%.

On a 12-month basis, the index rose 4.2%, down from 5.1% at the end of 2022. The Federal Reserve watches the ECI for clues on inflation.

—Jeff Cox

Boeing rises as investors analyze earnings, guidance commentary

Boeing climbed 2% before the bell after the plane maker reported earnings amid the looming 737 Max 9 crisis.

The company posted a smaller loss per share than analysts polled by LSEG anticipated for the fourth quarter, while revenue came in better than forecasted. But management didn't offer a 2024 outlook for investors as the company contended without the fallout of a fuselage panel blowing out midflight on a 737 Max 9 earlier this year.

Shares have tumbled more than 23% in January, making it the worst performer of the 30 stocks in the Dow.

— Leslie Josephs, Alex Harring

These are the companies making the biggest premarket moves

Check out the companies making headlines before the bell:

- Paramount Global — The media company's stock surged more than 13% in premarket trading on news that billionaire entrepreneur Byron Allen submitted a $14.3 billion takeover offer. The deal values Paramount at about $30 billion, including debt and equity.

- Advanced Micro Devices — The semiconductor company's shares slid 4.3% after posting fourth-quarter earnings Tuesday that came out in line with consensus expectations. AMD beat quarterly revenue estimates, but also gave a softer-than-expected first-quarter forecast.

- Mondelez International — Shares of the snack maker dropped 4.4% after the company reported a slowdown in growth for the fourth quarter and said it expects muted growth in comparable sales for 2024. Mondelez did post a beat on fourth-quarter adjusted earnings per share and in-line revenue, however.

For the full list, read here.

— Pia Singh

Private payroll growth slowed in January, ADP says

Private payroll growth decelerated in January, potentially signaling that the U.S. labor market is losing steam.

ADP data Wednesday showed private payrolls added 107,000 employees in January, while economists polled by Dow Jones forecast 150,000. The slowdown in the first month of 2024 was also below the downwardly revised 158,000 in December.

— Brian Evans

Tech investors may be 'selling the news' on Wednesday, Wolfe Research says

The high-flying Nasdaq is poised to open lower on Wednesday, and the recent run up for some of its biggest stocks could be partially the culprit for a bad one-day move. Wolfe Research strategist Chris Senyek said in a note to clients that the post-earnings moves for some major tech stocks may be in part a reaction to their recent success.

"Yesterday, several high-profile companies saw negative price action after missing expectations and/or providing disappointing guidance. Our sense is that the AMD & GOOGL selloffs after the market can be at least be partially attributed to investors 'selling the news' into high expectations after strong stock runs," the note said.

That doesn't mean that investors should completely ignore what has been an underwhelming run of earnings.

"However, some other economically-sensitive names that hadn't recently meaningfully outperformed also sold off, including UPS & MDLZ. While one day certainly doesn't make a trend, we viewed yesterday's price action as a warning sign that the economy may be slowing faster than consensus expects," the note said.

— Jesse Pound

Walmart shares are higher after 3-for-1 split announcement

Walmart announced late Tuesday it will implement a three-for-one stock split, sending shares higher by 1.3%. The split will take effect after market close on Feb. 23. The stock closed the previous session just below an all-time high.

— Fred Imbert

Novo Nordisk beats expectations amid weight-loss drug boom

Novo Nordisk on Wednesday reported sharply higher sales and forecast growth for 2024 between 18% and 25% as its drugs Ozempic and Wegovy, used to treat diabetes and for weight loss, experience increased demand.

The Danish pharmaceutical company's net sales rose 31% year-on-year in 2023, to 232.26 billion Danish krone ($33.7 billion). Operating profit rose 37%, while fourth-quarter profit was above expectations.

Novo Nordisk has soared in value over the last year, at times becoming Europe's most valuable firm by market capitalization.

The 2023 results were fueled by strong performance in the company's diabetes and obesity care division, with obesity care in particular spiking by 154% at CER to 41.6 billion.

Read more here.

— Jenni Reid

China's official manufacturing PMI in line with expectations for 49.2 in January

China's factory activity contracted for a fourth consecutive month in January, though the official manufacturing purchasing managers' index expectedly rebounded to 49.2 from 49 in December, a six-month low. January's reading is in line with the median forecast in a Reuters poll.

The official non-manufacturing managers' index rose to 50.7 in January from 50.4 in December, according to data from the National Bureau of Statistics released Wednesday. Strength in the country's services industry helped offset weakness in the construction sector amid a slump in the real estate sector.

A PMI reading above 50 indicates expansion in activity, while a reading below that level points to a contraction.

For more, please read the full story.

— Clement Tan

Shares of Samsung slip as operating profit plunges

Shares of Samsung Electronics fell 1.21% after the company posted a 34.57% drop in operating profit in the fourth quarter from a year ago, in line with its guidance issued earlier this month.

Here are Samsung's fourth-quarter results versus estimates:

- Revenue: 67.78 trillion Korean won (about $51 billion), vs. 69.27 trillion Korean won expected by LSEG analysts

- Operating profit: 2.82 trillion Korean won, vs. 3.43 trillion Korean won expected by LSEG analysts

In its earnings guidance earlier this month, Samsung said it expected operating profit for the October-December quarter to be 2.8 trillion South Korean won ($2.13 billion), down 35% from the same period a year ago when the firm reported an operating profit of 4.31 trillion won.

Read the full story here.

— Sheila Chiang

Australia's fourth quarter inflation rate slows to 4.1%, lower than expectations

Australia's consumer price index in the fourth quarter rose 4.1% year-on-year, slower than the 5.4% recorded in the third quarter and also lower than the 4.3% expected by economists polled by Reuters.

This also marks the fourth straight quarter where the inflation rate fell, and marks the lowest level since December 2021.

The trimmed inflation rate, which excludes the most volatile 30% of items, came in at 4.2%, falling from 5.2% in the third quarter.

— Lim Hui Jie

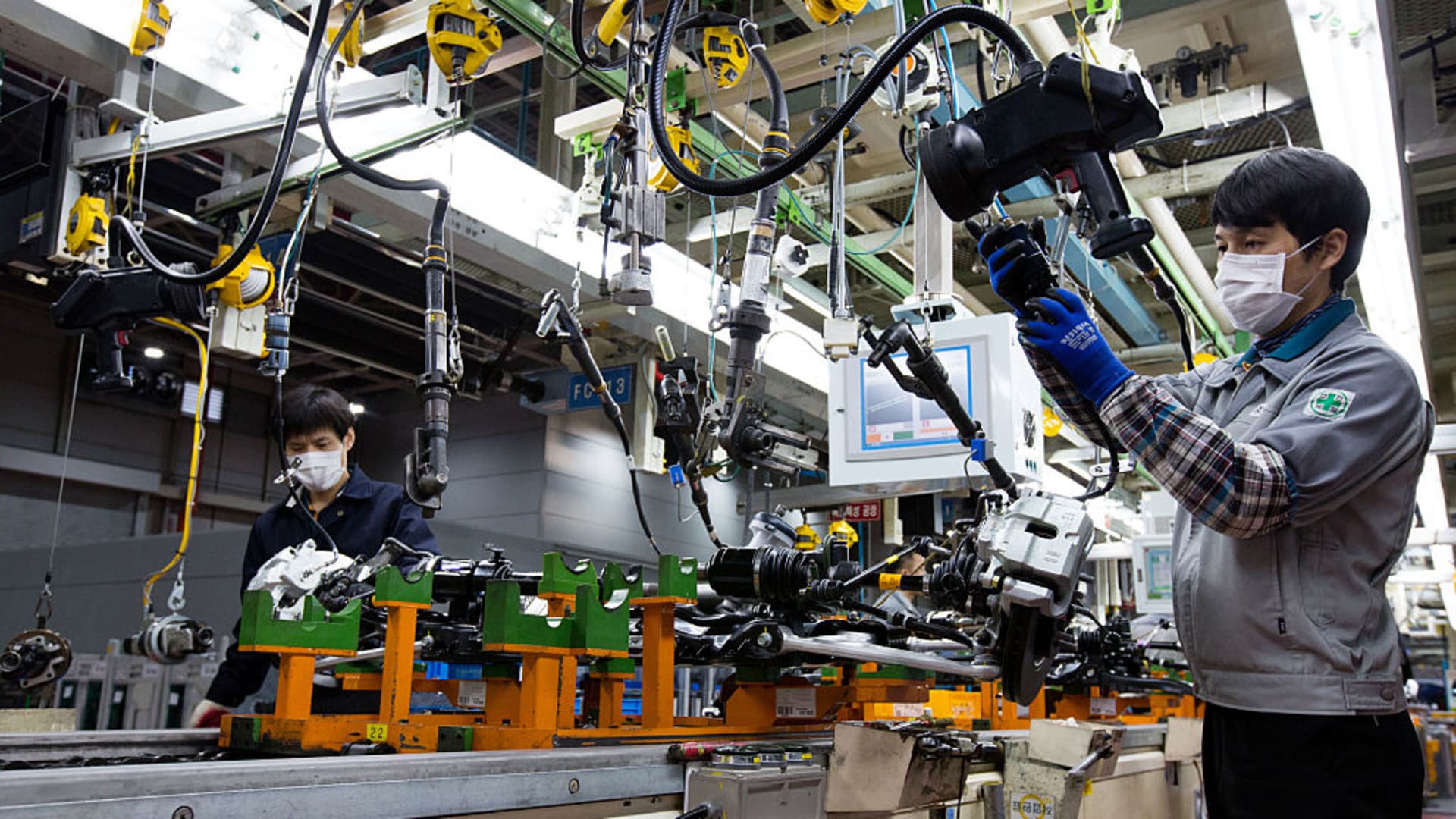

South Korea industrial output cools; retail sales falls in December

South Korea's industrial output cooled in December and retail sales fell, according to official data.

December manufacturing production index increased 0.6%, less than the prior month's 3.3% increase. The reading was still higher than a Reuters poll forecast of a 0.5% increase.

On the consumption side, retail sales in December fell 0.8% from the prior month and was up 2.2% from a year ago. That follows a 1% increase in November.

South Korea's Kospi opened 0.08% lower.

— Shreyashi Sanyal

Fed move toward rate cuts is 'like turning a battleship,' economist says

Wilmington Trust chief economist Luke Tilley said Tuesday that he isn't expecting any big changes in the Federal Reserve's posture tomorrow, but that the central bank could keep laying the groundwork for rate cuts later this year.

"When the Fed changes communication, it's really slow. It's like turning a battleship. They do it very, very slowly. And what they need to start pivoting towards is sort of confirming the expectation of rate cuts more and more," Tilley said.

The Wilmington Trust team expects the first rate cut from the Fed to come on May 1.

The Fed could also point to international developments like the conflict in the Middle East as a potential reason for caution on inflation, Tilley said.

"I think they will always point out risk factors, upside risk factors, for inflation, especially as they are trying to temper market expectations for a whole lot of cuts. I don't think that that would cause them to not cut, but they will definitely cite some of those risks," he said.

— Jesse Pound

Stocks making the biggest moves after hours

Check out the companies making headlines in postmarket trading.

Tesla — Shares of the electric vehicle company fell 3.6%. A Delaware judge agreed to void Tesla CEO Elon Musk's $56 billion compensation package. The decision involves a lawsuit filed by Richard Tornetta, a Tesla shareholder.

Electronic Arts — The stock declined more than 2% after its fiscal third-quarter revenue came in below estimates. EA reported $2.37 billion in revenue, while analysts had estimated $2.39 billion, according to LSEG.

Alphabet — Shares fell around 5.5% on the company's fourth-quarter results. Google ad revenue came in at $65.52 billion, short of analysts' expectations for $65.94 billion, per StreetAccount. Separately, Alphabet posted a beat on top and bottom lines.

The full list can be found here.

— Hakyung Kim

Nasdaq 100 futures fall Tuesday night

Nasdaq 100 futures fell 0.8% Tuesday night, as the pullback in Microsoft and Alphabet shares dragged down the tech-heavy index.

S&P 500 futures also slid 0.4%. Meanwhile, futures tied to the Dow Jones Industrial Average ticked up 33 points, or less than 0.1%.

— Hakyung Kim