This report is from today's CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Bracing for Fed meeting

U.S. stocks were little changed Monday as traders await the Federal Reserve's September meeting. The pan-European Stoxx 600 index sank 1.13%, with all sectors in negative territory. Lonza, a drugmaker, plunged 14.7% after the firm announced the departure of its CEO, and Societe Generale slumped 12.05% after the bank pledged to cut costs.

Top of the shelf

Instacart priced its initial public offering at $30 a share, the top end of its expected range. That gives the grocery delivery company a valuation of about $10 billion, a figure around 3.5 times its annual revenue. By comparison, DoorDash, a competitor, trades at 4.25 times. Instacart's the first venture-backed tech startup to list since December 2021, and will signal the health of the IPO market.

Get top local stories in San Diego delivered to you every morning. Sign up for NBC San Diego's News Headlines newsletter.

Most hours lost in decades

Strikes in the U.S. are hitting the economy at a level not seen in decades. 4.1 million labor hours were lost in August, the most in 23 years. Year to date, 7.4 million hours have been lost, compared with 636 hours for the same period last year. And more strikes could come. "If you're … not anticipating labor demands, you're not tethered to reality," Joseph Brusuelas, chief economist at RSM, said.

Monthly payment for X

X, previously known as Twitter, will charge users "a small monthly payment" to combat "vast armies of bots," Elon Musk said. Musk also divulged that X has 550 million "monthly users" who generate 100 million to 200 million posts per day. Separately, Turkish President Recep Erdogan invited Musk to build his next Tesla factory in Turkey, reported the country's state media.

[PRO] 'Sell Rosh Hashana'

This week's an historically bad week for markets, a sentiment encapsulated by the saying, "Sell Rosh Hashana and buy Yom Kippur." (The former, the Jewish New Year, started Friday, and the latter, a holy day in the Jewish calendar, ends Sept. 25 this year.) CNBC Pro's Bob Pisani unpacks whether that saying holds true this year.

Money Report

The bottom line

Stocks barely budged yesterday. All major indexes ticked up, but the gains were so tiny — measured in the hundredths of a percentage point — that it's better to think of them as unchanged. Trading volume was muted, too. Both the SPDR S&P 500 and the Invesco QQQ, which tracks the Nasdaq 100, traded around 25% fewer shares than their 30-day average.

It's not that investors aren't sure about what the Fed might do at its meeting Wednesday. They're all but certain the central bank will keep interest rates the same for now, according to the CME FedWatch Tool. It's the November meeting investors are fretting over. Currently, markets think there's a 31.3% chance of a hike — but that percentage has reached as high as 50.89% in late August. Those wild swings reflect the uncertainty over the November meeting.

Still, Goldman Sachs thinks "the FOMC can forgo a final hike this year, as we think it ultimately will," as the bank's chief economist Jan Hatzius wrote in a Sunday note. But with the U.S. economy running hot, the labor market remaining tight — and roiled by strikes — and oil prices surging again, it's no surprise the broader market doesn't really know what inflation — and hence interest rates — will look like for the rest of the year.

Hence, the Fed's dot plot, which charts where the central bankers think interest rates will be in the short- and long-term, will be closely scrutinized by investors. But Hatzius thinks even if members pencil in one more hike for the year, the Fed won't actually pull the trigger. It's "only to preserve flexibility for now," he wrote.

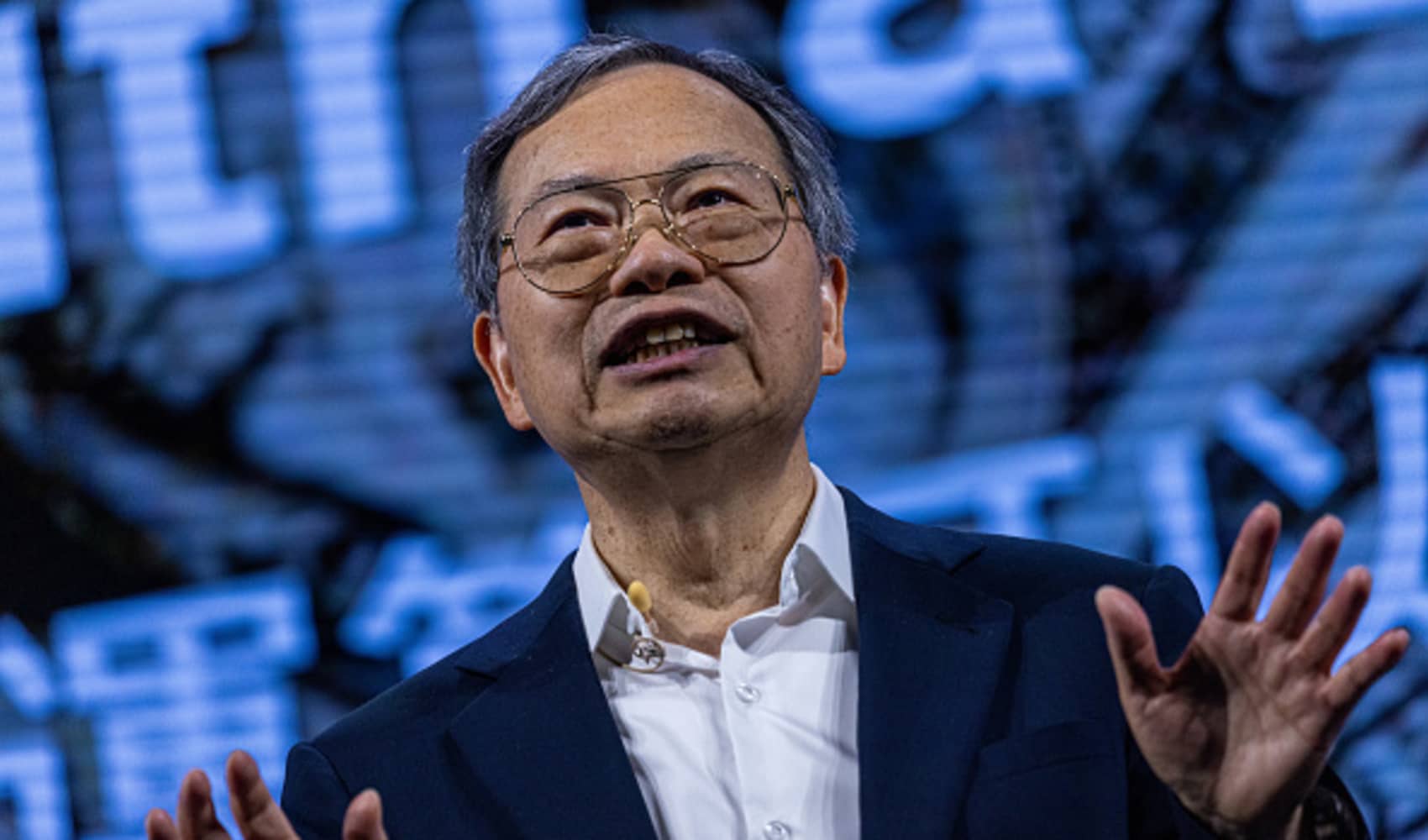

Perhaps we should give the Fed some benefit of the doubt. Ed Yardeni, president of Yardeni Research, is certainly doing so. "Generally speaking, Fed watchers like to criticize the Fed and suggest that they're always wrong about their forecast and what they are doing," Yardeni said on CNBC's "Squawk Box."

"But I think they're actually getting it right this time," Yardeni said. "And I think we may very well have immaculate disinflation, where inflation comes down without an economy-wide recession." This might be a brazenly optimistic prediction. But it's an undeniably cheery thought — one of the few certainties to be had today.