As millennials begin to turn 40 in 2021, CNBC Make It has launched Middle-Aged Millennials, a series exploring how the oldest members of this generation have grown into adulthood amid the backdrop of the Great Recession and the Covid-19 pandemic, student loans, stagnant wages and rising costs of living.

Every morning, Kristin Bennett starts her day off by swallowing about 14 different supplements and vitamins designed to help her keep the worst symptoms of her disease at bay.

Bennett has relapsing-remitting multiple sclerosis, a central nervous system disease she's been dealing with for about 20 years after being diagnosed in 2001. She just turned 40 last month.

Health conditions like Bennett's can take a toll, both financially and emotionally. And unfortunately, as the oldest millennials start to hit 40, many are finding themselves coping with chronic health conditions — more so than previous generations, according to some recent research.

Get top local stories in San Diego delivered to you every morning. >Sign up for NBC San Diego's News Headlines newsletter.

About 44% of older millennials born between 1981 and 1988 report having been diagnosed with at least one chronic health condition, according to a recent survey conducted by The Harris Poll on behalf of CNBC Make It among over 4,000 U.S. adults, about 830 of whom were between the ages 33 to 40.

There's "no question" that some emerging evidence shows many millennials are unhealthier than predicted, says Dr. Georges Benjamin, executive director of the American Public Health Association.

Money Report

"Hypertension, diabetes and obesity drives a lot of that," Benjamin says, adding that the obesity epidemic may be one of the root causes of the rise in rates of hypertension, diabetes and even certain types of cancer. Benjamin also says that studies show millennials are far less likely to be smokers, making diseases related to smoking less common.

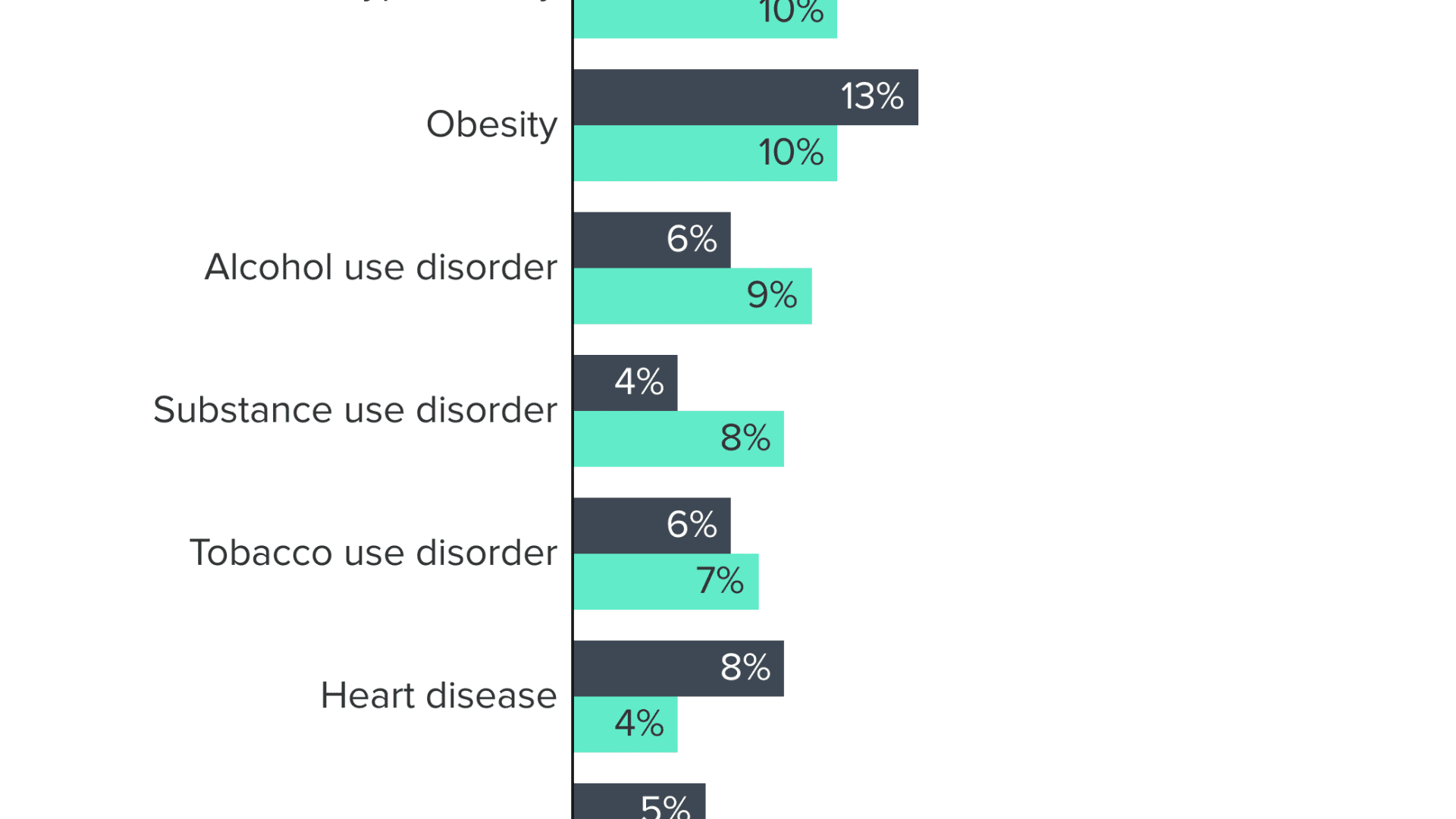

Among the older millennials surveyed by CNBC Make It, migraine headaches, major depression and asthma are the three most common ailments. Type 2 diabetes and hypertension round out the top five.

The prevalence of these diseases not only affects millennials' health and lifespan, but also their bank accounts. Studies show those with at least one chronic condition spend twice as much on out-of-pocket health-care expenses than those without any medical issues. Those with two concurrent chronic health issues spend five times as much.

Those under 65 with circulatory system diseases, such as high blood pressure and heart conditions, spend more than $1,500 a year on out-of-pocket costs, according to the Kaiser Family Foundation. The average health insurance plan participant without a chronic condition pays just $778 a year out of pocket.

Over the course of a lifetime, those costs can add up — especially if a patient is diagnosed at a younger age.

Beyond out-of-pocket spending, millennials with a chronic health condition also could see their annual income reduced by as much as $4,500 per person due to medical expenses and even reduced work hours or job loss because of poor health, according to a 2019 report from Moody's Analytics that analyzed data from Blue Cross Blue Shield Health.

"At the end of the day, if these trends continue, then you'll have higher health-care costs," Benjamin says. "You'll be exchanging the baby boomer generation for a generation with even higher health-care costs just because of normal inflation and the fact these chronic diseases are there."

To help keep her symptoms at bay, Bennett takes about a dozen supplements each morning, as well as other vitamins throughout the day. All told, she spends about $400 a month on more than 20 different vitamins, as well as powdered supplements she adds to drinks and smoothies. Bennett also sees a naturopathic doctor about once a month, a massage therapist when she can and attends physical therapy as needed. Those types of services can typically range from $75 to $150 per session.

But despite all the effort, Bennett started to experience flare-ups in 2018 that have persisted through the coronavirus pandemic, including falls, double vision and even trouble walking and standing for long periods. An avid gardener, one of her more serious falls ended with her hitting her head on a wooden stake after tripping outside of her home in Clinton, Washington.

Yet Bennett's health-care costs could be much higher. For eight years after her diagnosis, she was on medications that, without insurance, generally cost patients between $5,000 and $50,000 a year.

When she lost her job in 2009, Bennett spent most of her unemployment benefits paying for COBRA insurance to ensure she had coverage for both her medication and her pregnancy. But Bennett, now a mother of three, couldn't keep up with the costs and eventually stopped taking prescription medications in favor of a less expensive, more alternative medicine route.

Getting diagnosed with MS has given Bennett the mindset that anything can completely change at any given moment. "I don't really know what the future will bring," she says. "I'm still hoping that I can walk well again, but I also know that might not happen, and I might need a wheelchair someday."

Declining health is only one piece of the puzzle

While older millennials are experiencing higher rates of chronic health conditions, it may not be strictly due to declining health. The implementation of the Affordable Care Act in 2010, also known as Obamacare, increased access to health-care providers for many Americans. This was especially important for younger Americans, who were given the option to stay on their parents' health insurance plans until they were 26.

This helped more college students and recent grads afford and seek out medical care when they needed it. "It is true that we have improved access to care," Benjamin says. But, "when you improve access to care, then you see more people and you identify more health problems."

While that does potentially increase disease rates, it can be a good thing, Benjamin says. Identifying health problems early leads to better long-term outcomes, including longer life spans.

For Brady Dixon, doctors were able to catch his Type 2 diabetes early, when he was only 29.

Doctors diagnosed Dixon, now 35, with diabetes after a routine health exam for work uncovered critically high blood sugar levels in 2015. Although doctors were able to catch his condition before any real complications arose, diabetes is one of the most expensive chronic diseases to treat in the U.S. today. Those diagnosed with diabetes have an average of $16,750 in annual medical expenditures, $9,600 of which is attributed directly to diabetes, according to 2018 research from the American Diabetes Association.

For Oklahoma-based Dixon, the major costs have been his medication and food. After the first drug prescribed to Dixon left him sick for hours, he switched to another that he tolerated better, but more expensive. A month's supply of the drug, Trulicity, costs an average of $985 without insurance and $48 with insurance, according to GoodRx.

Dixon earns about $58,000 a year working in IT and spends about $200 more per month on food than he did before his diagnosis. But budgeting for specialty groceries and healthier takeout meals can be challenging, especially with jobs that don't always pay well and $8,000 in student loans still left to pay off.

"I learned that food was an under-the-radar cost of having diabetes," Dixon says. "Yes, if you cook everything at home, it's not that expensive. But the staples of cheap, easy food — frozen pizza and ramen — are both death to a diabetic."

More diagnoses could come after the pandemic lifts

As older millennials age, their habits, history and even world events will continue to impact their health. The pandemic will likely result in new shifts in health trends and potentially lead to an influx of diagnoses over the next year, Benjamin says.

While Covid-19 may not have been as fatal for younger Americans, including older millennials, many of those who contracted the disease experience ongoing symptoms months after recovery. In fact, studies show between 50% and 80% of recovered patients have persistent side effects for up to three months after their initial positive test.

Beyond Covid, the pandemic has led to a dramatic decrease in Americans visiting the doctor, Benjamin says. About 70% of physicians surveyed by the American Medical Association reported providing fewer appointments since the crisis started, including both in-person and virtual. Emergency room visits were down 25% in December 2020 and January 2021 compared with a year earlier, according to CDC data.

"Because we've been sequestered in our homes for a year, people have not gotten the screenings and medical care they need," Benjamin says. "As people go back to the doctor, we're going to find cancers that should have been caught earlier, we're going to find people who didn't get their immunizations, we're going to find the diabetes that was not diagnosed because they weren't at the doctor."

Increased diagnoses also means that more Americans may be paying higher health-care costs over the short and even long term if the health conditions are chronic.

That's been the case for Dixon, whose medication and food costs came to a head during the pandemic. He was laid off from his job in IT in March 2020 and on unemployment for six months last year. COBRA would've cost about $2,000 a month, so he didn't sign up. Instead, he stopped taking his medication and tried to get by simply monitoring his sugar levels and diet.

Last August, Dixon was finally able to secure a contractor IT role that turned into a full-time position in November. When he finally went to see a doctor covered under his new health insurance earlier this year, his sugar levels were critically high to the point where his risk of kidney and eye damage had increased.

His doctor put him back on Trulicity and added another medication to the routine as well. Thankfully his new job offers decent health insurance, so between that and discount drug programs, Dixon is spending $40 a month out of pocket for his medications.

Although he's getting back on track with his career and health, Dixon, who's still single, can't help but feel frustrated that he's not further along in his life. "I expected to own my own home between 25 and 30, and be married with children," he says.

"There are two things I think that really messed with the American dream for me. One is my student loans and the other is health problems."

CNBC Make It will be publishing more stories in the Middle-Aged Millennials series around student loans, employment, wealth, diversity and health. If you're an older millennial (ages 33 to 40), share your story with us for a chance to be featured in a future installment.