Susana Moreno and Gerardo Aguilar have celebrated many birthdays together but last year’s will always be cherished. The couple visited Courtesy Chevrolet in Mission Valley in May where they bought their dream truck, a 2023 Chevy Silverado.

But they hit a bump during the transaction. They told NBC 7 Responds their auto insurance at that time would not cover the new truck so they said the salesman recommended an insurance broker, Enoc Herrera. According to Moreno, the salesman called Herrera directly from his phone. They said they agreed to pay $419 in cash to the salesman and in return, they got a temporary insurance policy for the new truck and a 2002 Mazda they already owned. The following day they said Herrera texted them a receipt from Compadre Insurance Services, that’s the name of his business, for the money they paid.

About a month later, they visited Herrera’s office to finish the insurance paperwork. That’s when they say he gave them a printout of an “insurance coverage summary” with Progressive, an insurance company they believed had coverage with. Moreno says she sent $443 via Zelle to Herrera for that policy.

Get top local stories in San Diego delivered to you every morning. Sign up for NBC San Diego's News Headlines newsletter.

During that time, things seemed to be going well the couple said. But days later, a DMV letter took them for a loop when it warned them their new truck’s registration would be suspended for lack of insurance.

“I called him and asked him what was going on,” said Aguilar. According to him, Herrera assured him everything was fine. In August, a second DMV letter hit their mailbox, this time alerting them their Mazda’s registration was suspended for the same reason.

Moreno said she called the broker right away and that he told her it was just a misunderstanding and he would fix it. They believed him, so they decided to add two more cars and their daughter as an additional driver to their policy in September. They have a receipt from Compadre Insurance Services showing that they paid him $795 for that addition to their policy.

To this day, the couple is still confused about what happened to the money they paid for coverage. All they know is it never arrived where it was supposed to, their car insurance policy.

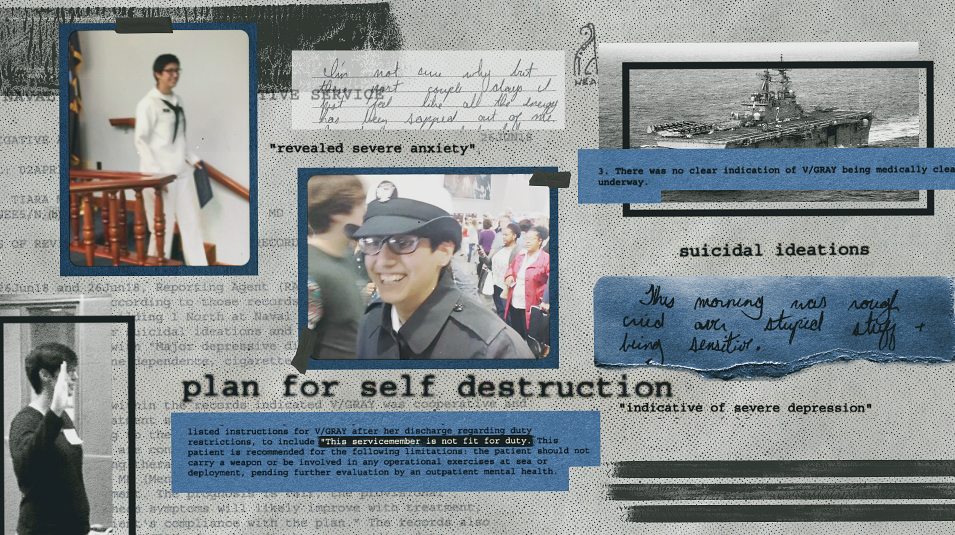

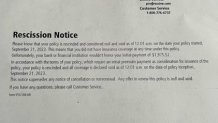

Later that month, they received another surprise. The couple was hit with a letter from Progressive saying the policy was “rescinded and considered null and void.” The letter continued saying, “This means you did not have insurance coverage at any time under this policy. Unfortunately, your bank or financial institution wouldn’t honor your initial payment.”

Local

That is when the couple said they decided to call Progressive directly. The company explained the policy was never active and confirmed it in an email sent to them by the Corporate Investigations Department.

Moreno said she felt confused about where her payments had gone, so she called Herrera asking to return the money they sent him. She told us he agreed to do so, but said she couldn’t trust him anymore, and they didn’t feel comfortable going back to his office.

“I called the dealer and told them how is it possible that this happened with someone who the dealer recommended,” said Moreno.

She was told someone would get back to them, but when that didn’t happen, they called NBC 7 Responds for help.

“I had also heard from you, that you always help and I said well, I'm going to call and hopefully someone will answer. And you answered quickly,” said Moreno.

NBC 7 Responds started digging on their behalf and found out that the California Department of Insurance, CDI, shows that Compadre Insurance Service’s license expired in November 2020. CDI’s website also shows that Enoc Herrera’s license expired in March 2021.

The CDI confirmed the information in an email they sent us saying, “Our records indicate Mr. Herrera is no longer licensed to transact insurance.”

NBC 7 Responds contacted Courtesy Chevrolet to ask about their protocols when referring a client to an insurance agent or broker. They told us they use a third-party company and the customer is the one who initiates contact, not the salesman. However, they acknowledged that’s not what happened with Moreno and Aguilar and called it a one-time mistake. They didn’t want to do an interview but explained that they had just arranged a meeting with Herrera and the couple so they could get their money back.

Days later, that meeting took place at the dealership. NBC 7 Responds waited nearby and met up with Moreno and Aguilar after.

“He gave us our money back. Everything that he had to return us for all the problems we had,” Moreno said.

They told us Herrera gave them $2,186 for the insurance premiums they paid him and the fees they paid to reinstate their car registrations.

“We came out with more money than we expected,” Moreno told us. That’s because the dealership also gave them $2,990 for the trouble. They were refunded a truck payment and what they paid for a maintenance package. All said and done, it’s a total of $5,176 back in their bank account.

The day after the meeting, our team called and texted Herrera. He called us back and admitted that his California license had already expired when he sold insurance to Moreno and Aguilar. He also told us that he tried to pay their premiums, but the payments were returned due to issues with his bank, but would not elaborate. Our team invited him to sit down with us for an interview, but up to now, he hasn’t agreed.

“Thank you very much to you, to Telemundo, because you helped us a lot,” Moreno said with a smile on her face.

In the meantime, they are just happy to have their money back. They told us they’re grateful to Courtesy Chevrolet for their help resolving the issue. They bought a new insurance policy, this time, directly from Progressive.

In November, the couple filed a complaint with the CDI against Herrera. The department told us it’s still investigating, and didn’t have any updates to share.

Something to remember is that if you do business with an insurance agent or broker, you should always check their license status with the California Department of Insurance to avoid any problems.