This November, San Diego County voters cast votes on 10 California ballot propositions and various local measures.

Two such measures arguably attracting the most attention are Measure E — a 1% increase to the sales tax rate in the city of San Diego — and Measure G, a .05% sales tax increase countywide, with both facing headwinds, especially Measure G.

Measure E, which proponents said could help to upgrade stormwater systems, potholes, street lights, parks and libraries, was also soft in its support, as was Measure G, a transportation-focused referendum that touted express service from the border through downtown on the Blue Line trolley, a rail line to relieve traffic on the 805, plus a rail connection to the airport.

Statewide props that include bond money for several projects are, up till now, a mixed bag, with voters so far supporting measures for schools and a slew of climate and clean water projects, but Prop 5, which would provide money for affordable housing and infrastructure, faced stiff opposition. Californians were also tepid in early voting for the prospect of raising the minimum wage, granting more rent control to local governments and a measure that would have eliminated forcing inmates to work.

Get top local stories in San Diego delivered to you every morning. >Sign up for NBC San Diego's News Headlines newsletter.

Here are the complete results:

Measure G: Sales tax increase for county projects

Whether you live in or outside San Diego city limits, you will be voting on another sales tax increase, Measure G.

Decision 2024

If approved, it would increase sales tax by half a percent across the entire county. If it passes, it’s projected to rake in $350 million a year. The purpose: a major public transportation glow up.

Among its listed projects is an express service from the border through downtown on the blue line. And a new rail line to relieve traffic on the 805. Plus a rail connection to the airport, and 24-hour services.

This measure requires a simple majority (51%) to pass.

Measure E: Increase San Diego city's sales tax

Measure E asks voters to raise the sales tax in the city of San Diego by one percentage point, from 7.75% to 8.75%. That’s projected to bring about $360-400 million a year to the city’s general fund.

City leaders like Councilmember Raul Campillo say they plan to spend that money mainly on infrastructure. That includes things like stormwater, potholes, street lights, parks and libraries.

The fact the money is earmarked for the general fund instead of a specified cause makes Measure E a lot easier to pass. This way city leaders only need a simple majority to vote yes (more than 50 percent of ballots), instead of two-thirds.

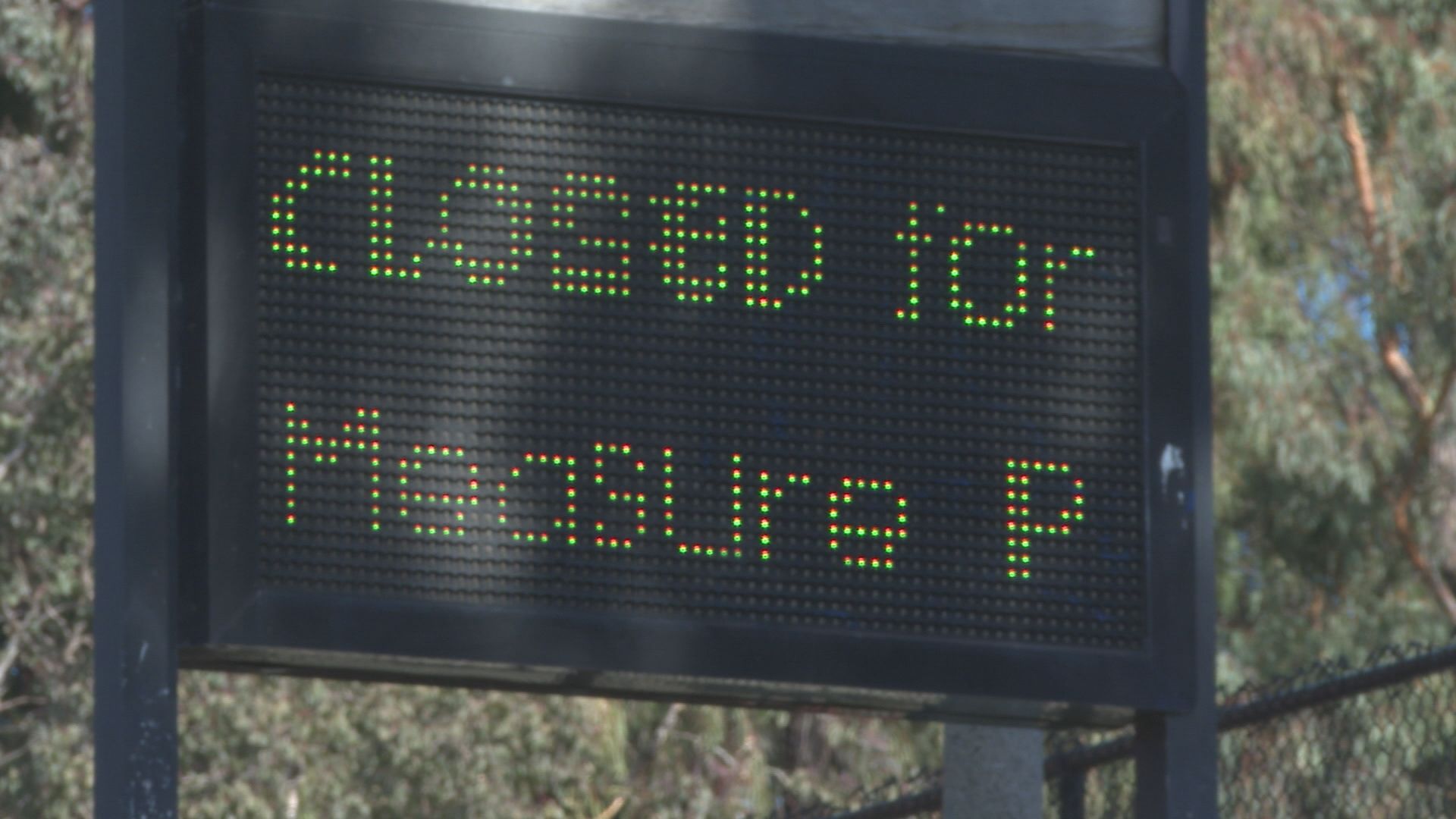

Measure P: Renew Chula Vista's half-cent use tax

Measure M: Del Mar short-term rental tax

Measure A: Increase Del Mar City Council salary

Measure J: Continue El Cajon critical services sales tax

Measure K: Increase Encinitas sales tax

Measure I: Increase sales tax in Escondido

Measure L: Continue La Mesa's existing sales tax

Measure T: Increase sales tax in Lemon Grove

Measure R: Special parcel tax in National City

Measure X: Extend Oceanside's sales tax

Measure H: Amend plans for 'The Farm' in Poway

Measure Q: Increase San Marcos sales tax

Measure S: Half-cent sales tax in Santee

Prop 2: Bonds for public school, community college facilities

Proposition 2 is a $10 billion bond measure to build schools, with most of that money going to kindergarten through 8th-grade schools in the state.

Prop 3: Constitutional right to marriage

In 2013, a U.S. Supreme Court ruling nullified California’s controversial Proposition 8 — the voter approved state constitutional measure that officially defined marriage as between a man and a woman. But more than a decade later, the inert measure remains on the state’s constitution.

Now, activists hoping to nullify Prop 8 once and for all are going to the November ballot with Prop 3, another constitutional measure that would officially scrub Prop 8 from the state books and declare same-sex marriage a fundamental right.

Prop 4: Bonds for safe drinking water, wildfire prevention

Proposition 4, The Safe Drinking Water, Wildfire Prevention, Drought Prevention and Clean Air Bond Act of 2024, would authorize a $10 billion bond with the money going toward a slew of climate and environmental programs addressing everything from sea level rise and sustainable farming to clean water. The bond would help offset recent state budget cuts that resulted in cuts to programs intended to address climate change-related issues.

Prop 5: Local bonds for affordable housing, public infrastructure

A "yes" vote on Proposition 5 would make it easier for governments to borrow money. A "no" vote would maintain the status quo.

When local governments in California want to borrow money, in the form of bonds, they need to seek voter approval through a measure on the ballot. Typically, these proposals require a supermajority of 66%. Prop 5 asks voters to lower that threshold to 55%.

Prop 6: Ending involuntary servitude for incarcerated persons

The California state constitution bans slavery, except as a punishment for a crime. Proposition 6 seeks to stop the practice of forced labor within state prisons.

Prop 32: Raising minimum wage

California's current $16 minimum wage is more than twice the federal minimum wage, which is $7.25. Even so, minimum wage workers in California come up about $20,000 short of the annual average cost of living in the Golden State.

Should voters approve Proposition 32, it would be the first statewide wage hike in nearly a decade.

Prop 33: Expanding rent control

There is discord among housing advocacy and tenant rights groups on the matter of Proposition 33, a measure that would give city governments expanded power to control rent costs.

For nearly three decades, California has had the "Costa-Hawkins" law in place. That restricts a city's capacity in terms of implementing rent control policies. Cities cannot impose rent control on single-family homes or apartments built after 1995. When a new tenant moves in, landlords can set their own rental rates.

Prop 33 aims to change that and give cities the power to set rent control for any kind of housing. Similar measures were rejected by voters in 2018 and 2020.

Prop 34: Restricting spending of prescription drug revenues

A federal law dating back 30 years gives health care providers who serve low-income patients a discount on pharmaceutical drugs. The providers can sell those drugs at market rate and make a profit, which they can use to expand health care for disadvantaged populations.

Proposition 34 would require providers to spend 98% of that profit on direct patient care but only if the health care providers meet certain specifications. They must spend at least $100 million on expenses outside direct care, own and operate apartment buildings and have at least 500 severe health and safety violations from the last decade.

Prop 35: Funding for Medi-Cal health care services

California Proposition 35 deals with how the state spends an existing health care tax and whether that tax should continue. It would also require that any money collected be used to offset Medi-Cal costs instead of going into the state's general fund.

The "for" argument itself says Prop 35 prevents the state from redirecting those funds for non-healthcare purposes and requires that 99% of the revenues go to patient care. It caps administrative expenses at 1%.

The tax is set to expire in two years, so a "yes" vote would extend it and require the money to go to Medi-Cal programs. A "no" vote would allow it to expire.

Prop 36: Increasing sentences for drug and theft crimes

Proposition 36, or the "The Homelessness, Drug Addiction, and Theft Reduction Act," rolls back Prop 47, which lessened the penalty for certain theft and drug crimes.

The ballot measure would revert to tougher punishment for repeat retail theft offenders and for people who traffic hard drugs. Those who successfully complete treatment would have the opportunity to expunge their records.